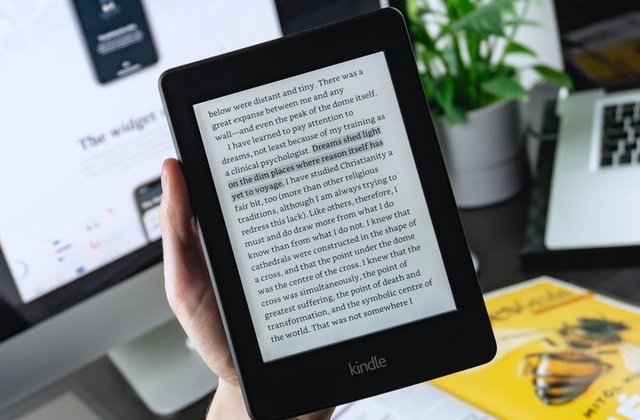

Amazon runs a Kindle store in China, and people usually buy their e-books here. However, the American tech and e-commerce firm stated on Thursday, June 2, that it would close down the e-bookstore.

According to Reuters, Amazon will no longer operate its Kindle store in China, and it will only be open until June 30, 2023. From this date, Chinese customers will not be able to buy new e-books.

Amazon will also totally stop supplying resellers with its Kindle reader, and this will be immediately in effect. The company did not provide any reason for the decision, and it only announced the pullout through its official WeChat account, which is widely used in China.

CNBC noted that Amazon’s shut down of its Kindle e-book store in China is the latest exit by an American tech company in the Chinese market. The company confirmed that it has already stopped furnishing third-party sellers with its Kindle devices, although some of the units are still up for sale on Amazon’s official store at JD.com, a Chinese e-commerce company headquartered in Beijing.

Chinese customers who previously bought e-books from Amazon’s Kindle store will still be able to redeem or download their purchases until June 30, 2024. These e-books will also be available and readable even after the end of the downloading date.

Then again, while Amazon is removing its Kindle store, it said that it is not completely pulling out its business in China. Jeff Bezos’ company said that it will still continue to operate some of its existing businesses in the country, including its logistics, devices, and ads.

“Amazon’s long-term development commitment in China will not change,” the firm said in a separate post on Weibo, another popular Chinese social media platform. “We have established an extensive business base in China and will continue to innovate and invest.”

In any case, Amazon started selling its Kindle e-readers in the country in 2013. The device quickly became popular among the Chinese, and it eventually became an important Amazon item in the device and tech market.

OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War

OpenAI Hires Former Meta and Apple AI Leader Ruomin Pang Amid Intensifying AI Talent War  Australia Targets AI Platforms With Strict Age Verification Rules

Australia Targets AI Platforms With Strict Age Verification Rules  Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand

Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand  Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates

Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates  Qantas Shares Plunge 10% as Iran Strikes Send Oil Prices Soaring and Disrupt Global Flights

Qantas Shares Plunge 10% as Iran Strikes Send Oil Prices Soaring and Disrupt Global Flights  Asian Currencies Slide as US-Israel Strikes on Iran Trigger Oil Surge and Risk-Off Rally

Asian Currencies Slide as US-Israel Strikes on Iran Trigger Oil Surge and Risk-Off Rally  Hyundai Motor Group to Invest $6.26 Billion in AI Data Center, Robotics and Renewable Energy Projects in South Korea

Hyundai Motor Group to Invest $6.26 Billion in AI Data Center, Robotics and Renewable Energy Projects in South Korea  OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute

OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute  Lynas Rare Earths Shares Surge 7% After Malaysia Renews Processing Plant Licence for 10 Years

Lynas Rare Earths Shares Surge 7% After Malaysia Renews Processing Plant Licence for 10 Years  Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock

Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock  Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target

Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  Global Markets Reel as Euro Falls, Swiss Franc Surges and Oil Prices Spike After U.S.-Israel Strike on Iran

Global Markets Reel as Euro Falls, Swiss Franc Surges and Oil Prices Spike After U.S.-Israel Strike on Iran  Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran

Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran  Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA  Netflix Declines to Raise Bid for Warner Bros. Discovery Amid Competing Paramount Skydance Offer

Netflix Declines to Raise Bid for Warner Bros. Discovery Amid Competing Paramount Skydance Offer  FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications

FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications