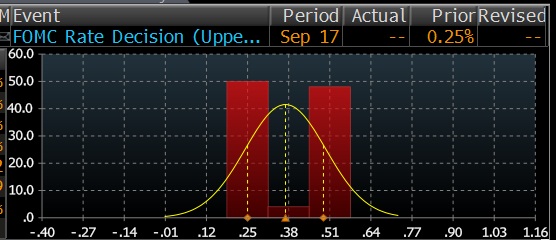

Considerable uncertainty is surrounding FOMC rate decision tomorrow, as analysts, economists and market participants all divided in their expectations.

Bloomberg survey shows that its participating economists are evenly divided too, 52 calling for a hike tomorrow, while 50 calling no.

This high level of uncertainty might generate extreme volatility tomorrow if FOMC participants decide to pull the trigger. Arguments are strong for either side.

No sayers calling for more patience and wait and watch from FED as inflation remains too low to pull the trigger. Moreover recent financial markets turmoil and emerging market crisis are key points in their debate, with low global inflation and weak global growth being at the center.

Yes camp is sighting improvement in employment as key and arguing, if FED is to move this year, why not in September then? Hike in September would provide FED to keep the path smooth and slow. They also argues if inflation rises FED would be in ready stance to take further action.

Dollar is down heading into FOMC tomorrow, trading at 95.28, down -0.32% so far today.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings