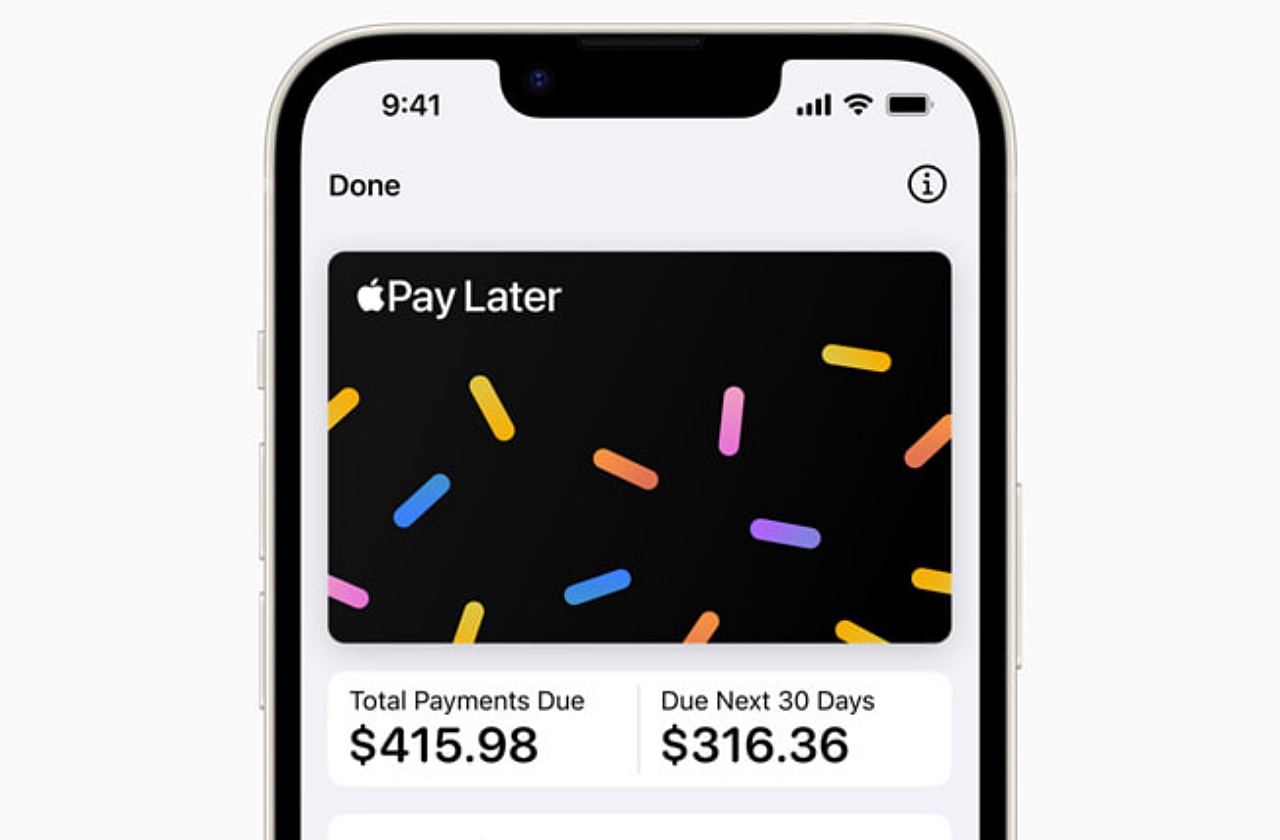

Apple Inc. announced on Tuesday, March 28, that it has rolled out a service that will give its Apple Pay users a new option to pay for their online purchases. The technology company based in Cupertino, California, said its digital wallet is now offering a buy now, pay later payment option.

With Apple’s addition of the new payment scheme that will allow users to pay in installments, it has become the latest major brand to dive into the buy now, pay later trend. The company said that through the BNPL plan, Apple Pay users could choose to pay in four installments with zero interest. Moreover, the company said there are no extra fees to pay for the service, according to CNN Business.

The iPhone maker said that the new feature on its digital wallet is called Apple Pay Later. Users can pay back the installments in over six weeks, and the first payment is due at the time of purchase. Moreover, another feature that users can enjoy from the BNPL plan is the loan.

Apple users can apply for a loan directly within the Apple Pay wallet app. The loan amount can range anywhere from $50 to $1000. The best part is that there is no interest or fees in online or in-app transactions.

Apple Pay Later will initially be available to select users in the United States. Apple will send invites to select individuals to access a pre-release version of the new Apple Pay Later this week. Later, the company will offer the service to all eligible customers, and this may happen in the next several months.

“There is no one-size-fits-all approach when it comes to how people manage their finances. Many people are looking for flexible payment options, which is why we are excited to provide our users with Apple Pay Later,” Vice president of Apple Pay and Apple Wallet, Jennifer Bailey, said in a press release.

She added, “Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates

Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates  IMF Urges U.S. to Cut Fiscal Deficit to Reduce Trade and Current Account Gaps

IMF Urges U.S. to Cut Fiscal Deficit to Reduce Trade and Current Account Gaps  Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute

Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute  Tokyo Core Inflation Slows Below 2%, Complicating BOJ Rate Hike Outlook

Tokyo Core Inflation Slows Below 2%, Complicating BOJ Rate Hike Outlook  PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation

PBOC Scraps FX Risk Reserves to Curb Rapid Yuan Appreciation  Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline

Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline  Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran

Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran  FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications

FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications  Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure

Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure  Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift

Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift  Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock

Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock  Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty

Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty  OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute

OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute  Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets

Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets  BlueScope Steel Shares Drop After Rejecting Revised A$15 Billion Takeover Bid

BlueScope Steel Shares Drop After Rejecting Revised A$15 Billion Takeover Bid  FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules

FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules