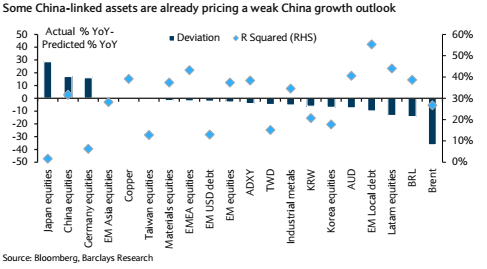

Chinese growth has been slowing since 2011, so asset prices that are linked to China have been pricing in slower growth prospects long before the recent changes to CNY. How far have these assets gone relative China's growth outlook?

The framework prepared by Barclays helps to address whether China-related assets are pricing in too much negativity from China's growth outlook. Thie bank measures this by running a regression of the year-on-year changes in these assets on China IP growth since 2000.

Above figure shows the difference between the latest y/y percentage change (as of 20 August) and the model prediction. The R-squared of the regression is also shown to check whether the prior view of a link to Chinese growth is confirmed by the data.

According to the framework, assets such as Brent oil, the BRL, LatAm equities, EM local debt and the AUD already price in more bad news than the July China IP growth would predict alone, says Barclas in a research note on Monday.

By contrast, China, Japan and German equities have been resilient to slower Chinese growth, perhaps reflecting support from other factors such as equity purchases by Chinese authorities, solid equity fundamentals in Japan, and aggressive monetary policy and reduced Greece-related stress in Europe.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed