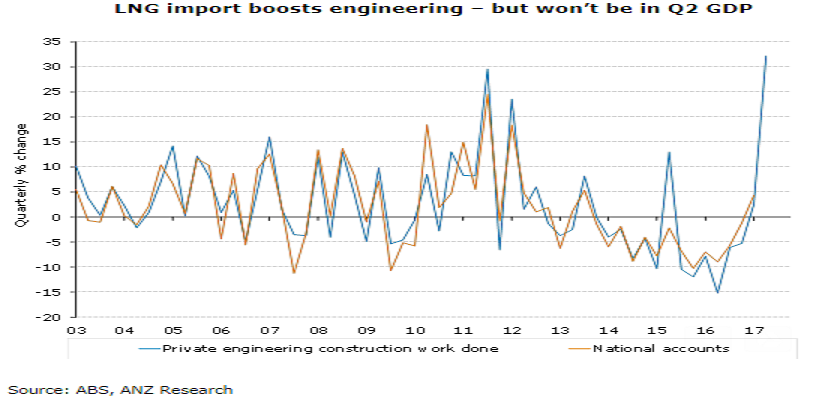

Australia’s Construction work done posted a strong headline number, but weak underlying results in Q2. Aside from the strength in engineering construction due to an LNG platform import that will not flow through to Q2 GDP, housing construction declined further, and private non-residential building was also disappointing. The public sector fared much better as expected, but the upshot of these results is that privately funded construction will not provide much, if any, support to Q2 GDP.

The headline construction number for Q2 showed a sharp 9.3 percent rise in activity. However, the underlying details were much weaker. Almost the entirety of the strong number was due to an AUD4bn jump in engineering construction in Western Australia, which is believed to be due to the import of an LNG platform for the Ichthys project.

Outside the strength in engineering activity, other details were soft. Housing construction posted a disappointing -0.4 percent q/q fall. While activity did rebound as expected in Queensland following the weather-affected Q1, weakness across most other regions saw the overall result slip.

"Any decline in housing construction is likely to be slow and steady, however. Combined with strength in housing finance, it is possible that building approvals have already troughed, at a higher level than previously anticipated. There is still a significant pipeline of work which will support activity for an extended period," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran