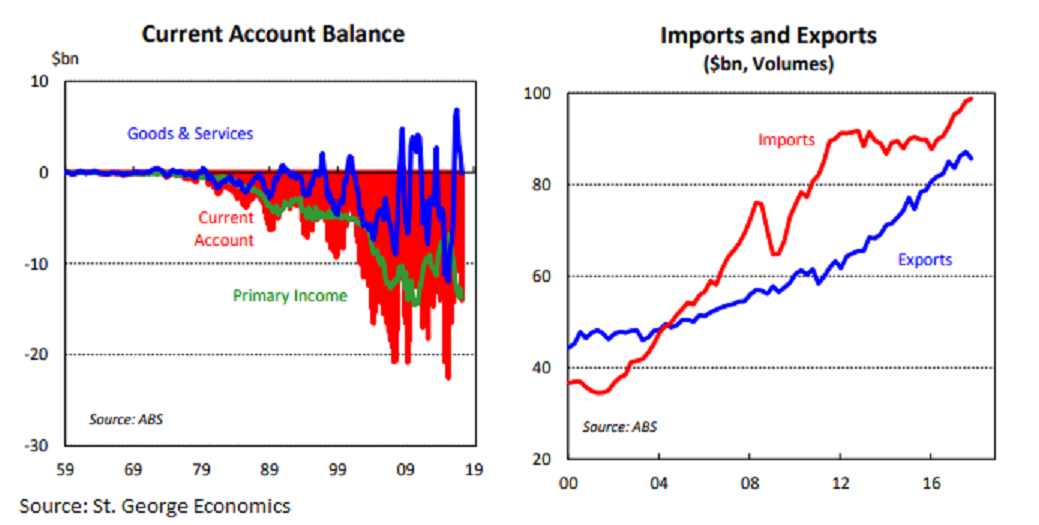

Australia’s current account deficit widened from a revised deficit of AUD11.0 billion in the September quarter to AUD14.0 billion in the December quarter, the largest deficit in over a year. The blow out in the current account deficit was mostly due to a turnaround in the goods and services balance from a surplus of AUD2.0 billion in the September quarter to a deficit of AUD117 billion in the December quarter.

Export volumes were negatively impacted by rural good exports, which fell 9.7 percent, and were affected by poor weather. Coal exports were also temporarily affected, but are expecting to rebound early this year. The combination of weaker export volumes and the lift in import volumes point to a 0.5 percentage point detraction from GDP growth in the December quarter.

"We remain comfortable with our forecast of 0.6 percent GDP growth in the quarter for an annual pace of 2.6 percent," St. George Economics commented in its latest research report.

It represents a moderate pace of growth, not far from the long-run trend. Business investment and public spending are expected to grow modestly and are expected to be the key drivers of growth in the coming year. They are drivers at a time when there are downside risks for consumer spending and as a downturn in dwelling investment takes hold.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January