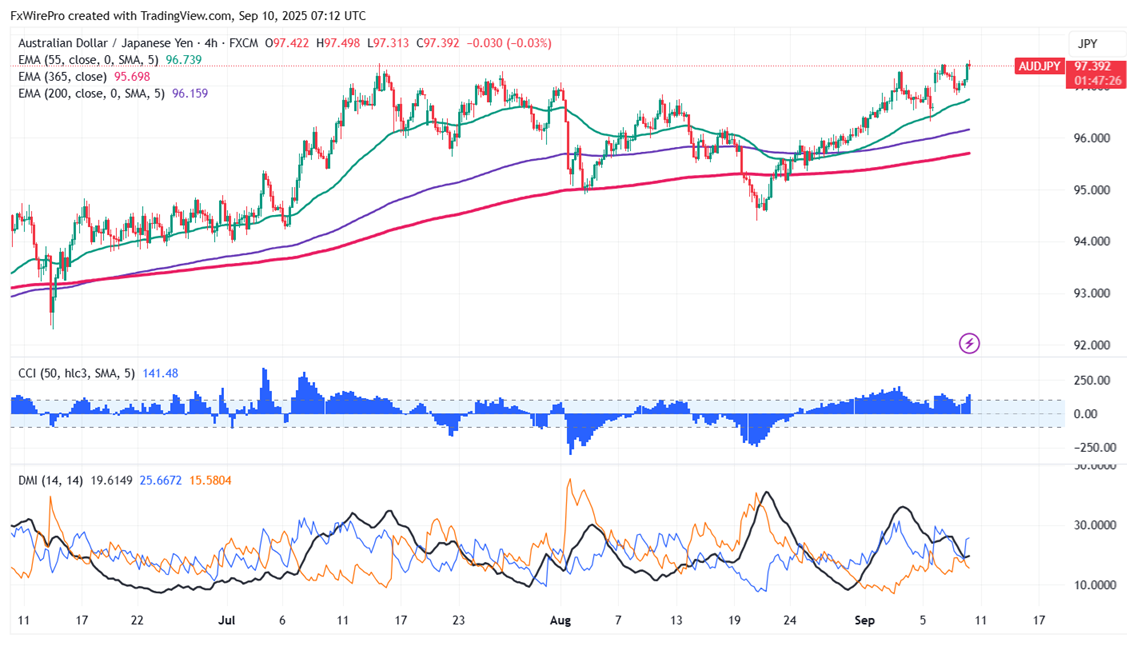

The AUD/JPY declined slightly as the Australian dollar dropped due to profit booking. It reached an intraday high of 97.50 and is currently trading around 97.372. The intraday trend remains bullish as long as support at 96.40 holds.

The pair is trading above 55 and 200 EMA and 365 EMA (long-term) on the 4-hour chart, confirming a bullish trend. Any violation below 96.60 indicates the intraday trend is weak. A dip to 96.30/96/ 95.50/95/94.40/93.95/93 is possible. Immediate resistance is at 97.50, a breach above this level targets 98/98.75/100/100.42.

Market Indicators (4-hour chart)

CCI (50)- Bullish

Directional movement index -Neutral

Trading Strategy: Buy

It is good to buy on dips around 97 with SL around 96 for a TP of 98.75/100