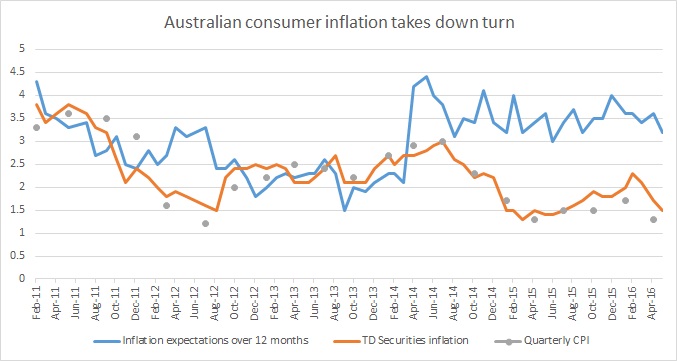

After rising through 2015, Inflation in Australia has started feeling the gravity this year once more, which led Reserve Bank of Australia to cut rates by 25 basis points in its April meeting. In first quarter of 2016, Australian CPI has declined to 1.3% y/y, down from 1.7% observed in fourth quarter of 2015.

TD securities inflation, released from University of Melbourne has been pointing that second quarter will be no different. Inflation in April has declined from 2.1% y/y in February to 1.7% in March and further 1.5% in April.

Today another measure was released from Melbourne, consumer inflation expectations over next 12 months. In February 2014, that gauge jumped a lot and has since then overestimated actual inflation over 12 month’s horizon however the trend has been relatively in line with other inflation measures. Consumers have now projected in survey released today inflation 12 months ahead at 3.2%, compared to 3.6% in January survey.

Australian Dollar has found some support around key level support at key level around 0.73 area. However with inflation outlook deteriorating, RBA changing its stance and iron ore giving up gains, weak Dollar won’t be enough to support Aussie. Currently trading at 0.734 against Dollar.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022