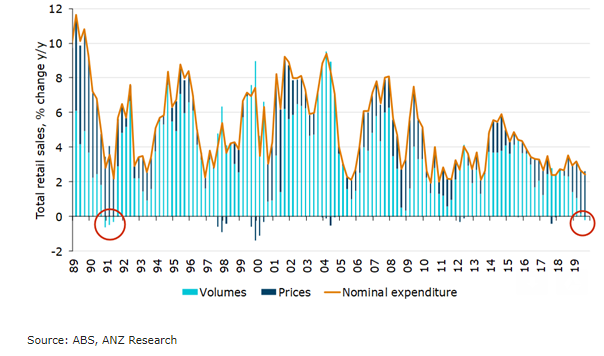

Australian nominal sales rose weakly in the month of September. On a sequential basis, retail sales grew 0.2 percent, below market expectations of a rise of 0.4 percent. With rapidly accelerating food prices, this is not sufficient to bring volume growth in the third quarter, noted ANZ in a research report.

Today’s print brought quarterly sales growth to 0.5 percent in nominal terms. This is the lowest result since March 2018 and well below the one-year, three-year and long-term average rates of growth. In terms of volumes, retail sales dropped 0.1 percent quarter-on-quarter for the third time in the last four quarters. Rapidly rising food prices, which grew 0.5 percent, are still the biggest element of nominal sales growth.

Yet another rise in food prices was the main driver for soft volumes, with volumes for food retailers and cafes/ restaurants dropping 0.3 percent in aggregate. Food and related categories represent 54 percent of total retail spending.

Discretionary categories excluding eating-out fared much better in volumes, with 0.5 percent quarter-on-quarter volume growth throughout all non-food categories. Clothing volumes rose 3 percent year-on-year, while department stores and other retailers recorded modest year-on-year volume growth. Household goods recorded flat volumes over the year.

Tax cuts were not sufficient to counter household budge challenges such as high debt, flat wages, caution about the economy and rising living expenses.

“However, in the September data we continue to see jumps in discretionary categories, which generally fare well with lump sum payments. Recreational goods and electrical goods saw above-average growth for the month, and the long-pained newspaper and books category saw huge growth of 1.5 percent m/m in September”, stated ANZ.

Australian nominal sales rise below expectations in September

Monday, November 4, 2019 6:26 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX