Australia’s retail sales remained unchanged during the month of June, albeit surpassing market expectations. However, on a quarterly basis, retail sales jumped than the prior, beating consensus estimates massively.

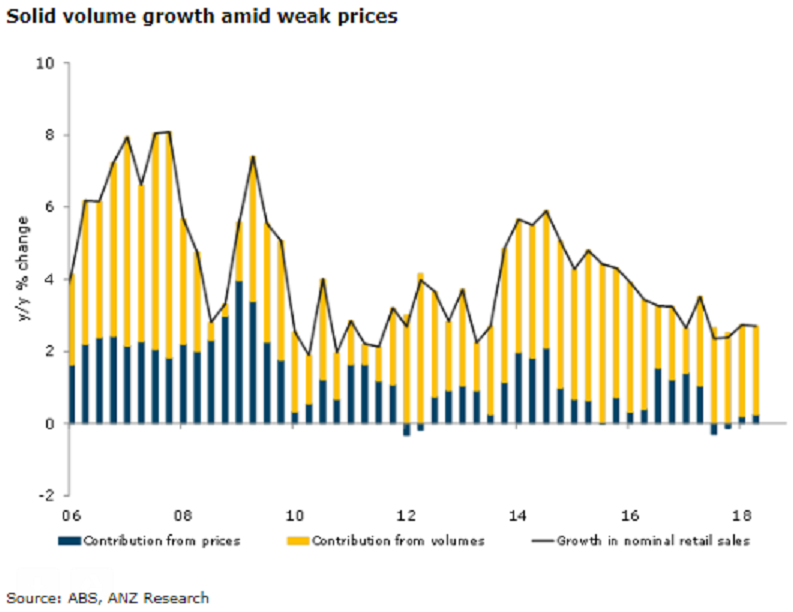

Retail sales rose 0.4 percent m/m in June, a touch stronger than expectations, but retail volumes over the quarter were much stronger than forecast, up 1.2 percent q/q. This continues the see-saw pattern of retail volumes growth since September 2016. Annual growth in retail volumes was steady at 2.5 percent y/y for the third consecutive quarter.

Sales volumes were led by department store sales (up 2.2 percent q/q) and clothing and soft goods (up 2.0 percent q/q), but all categories recorded volumes growth. In annual terms, sales volumes for clothing and soft goods are up 6.2 percent y/y while sales of households good are up 4.6 percent y/y. The weakest volumes growth in annual terms was in cafes, restaurants and take-away, up just 0.4 percent y/y. Perhaps that’s not surprising given it is this category where price are rising the most, ANZ Research reported.

In the month of June, sales of clothing and soft goods rose 1.7 percent m/m (the second consecutive strong result) while department store sales fell 1.2 percent m/m. Nominal sales were 2.9 percent higher in the year to June. Sales in Victoria were very strong in June, up 1.1 percent m/m and 5.8 percent y/y compared to a more modest 0.4 percent m/m rise in New South Wales. Sales in Queensland fell in June (-0.3 percent m/m) after two strong months.

"From a policy perspective, the RBA will take some comfort that falling house prices do not seem to be impacting household spending – at least at this point," the report added.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks