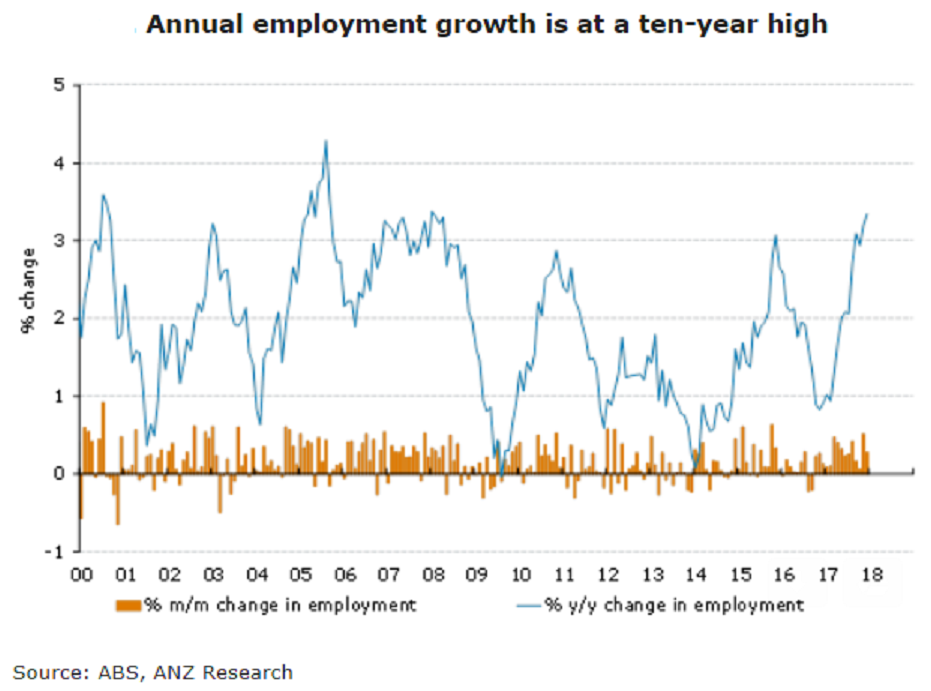

Australia’s unemployment rate is expected to trend lower over the next few months, which should help to support an eventual recovery in wage growth, according to a recent report from ANZ Research.

Looking at the country’s December employment report, we see that the labor market clearly remains in great shape, with another strong gain in employment in December confirming that underlying momentum in the economy remains solid. Encouragingly, the rise in the participation rate to a near record high suggests that the strength of the labor market is pulling more workers back into the labor force.

Employment rose a strong 35k in December, following the upwardly revised 64k rise in November. This is the fifteenth straight monthly rise in employment, a feat which has only occurred once before in the history of the monthly labor force numbers. Full-time employment was solid with a rise of 15k, while part-time jobs rose 20k. Hours worked ticked lower by 0.2 percent m/m, but are still running 3.2 percent above a year ago levels.

The strength was concentrated in NSW (+14k), with Western Australia also posting a solid gain (+6k). Employment fell in both Victoria (-4k) and Queensland (-4k).

"While the strong gains in employment and participation continue to suggest that the economy is in good shape, we remain of the view that there has been some overshoot in the jobs numbers recently and look for more moderate gains in the months ahead," the report commented.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target