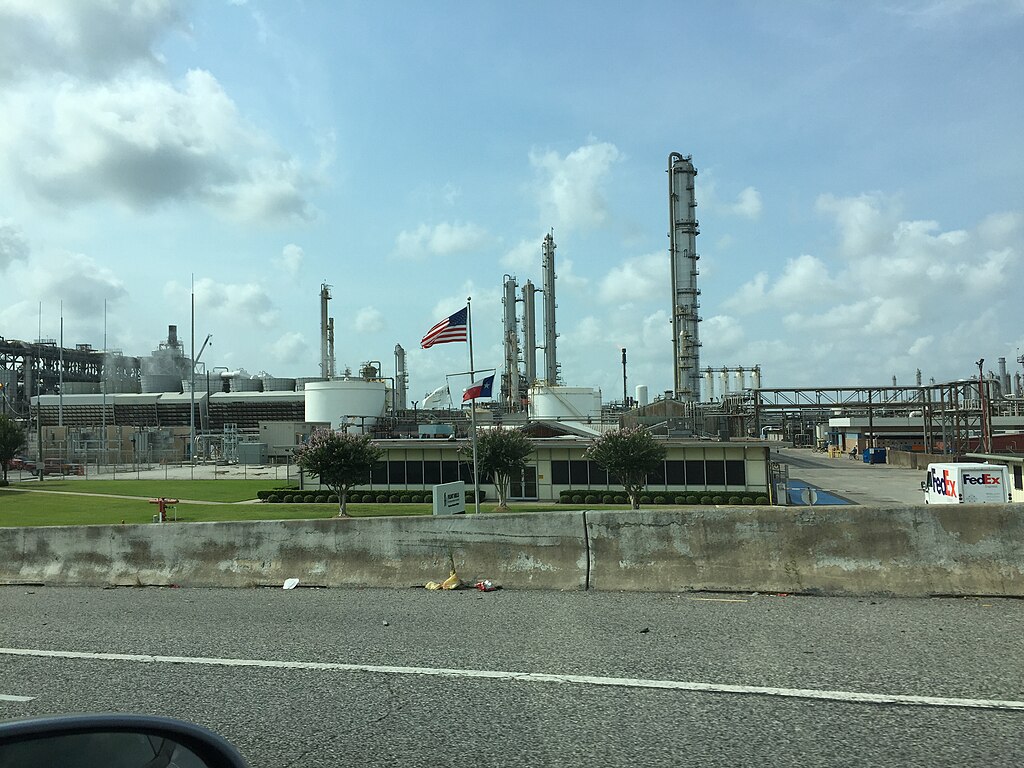

Oil prices remained stable on Tuesday as traders assessed the impact of new U.S. trade tariffs. Brent crude futures edged up 11 cents (0.14%) to $75.98 per barrel, while U.S. West Texas Intermediate (WTI) crude rose 5 cents (0.07%) to $72.37.

President Donald Trump imposed a 25% tariff on all steel and aluminum imports without exemptions, targeting shipments from Canada, Brazil, Mexico, South Korea, and others. The move, aimed at supporting U.S. industries, raises concerns about a potential multi-front trade war that could slow global economic growth and weaken energy demand.

Last week, Trump delayed 25% tariffs on Mexican and Canadian imports and 10% duties on Canadian crude oil until March 1, pending negotiations. Meanwhile, China retaliated against U.S. tariffs with a 10% levy on American crude imports, set to take effect Monday. Trade talks between the two nations show no signs of progress, adding further uncertainty to global markets.

Additionally, the U.S. Federal Reserve is expected to hold interest rates steady until next quarter. A delay in rate cuts could curb economic growth and, in turn, limit oil demand. Economists had previously predicted a rate reduction in March, but inflation concerns may keep rates elevated.

On the supply side, U.S. crude and gasoline stockpiles likely increased last week, while distillate inventories may have declined, according to a preliminary Reuters poll. Official data from the American Petroleum Institute is due Tuesday, followed by an Energy Information Administration report on Wednesday.

Market sentiment remains cautious as investors weigh trade tensions, economic risks, and energy demand forecasts.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns