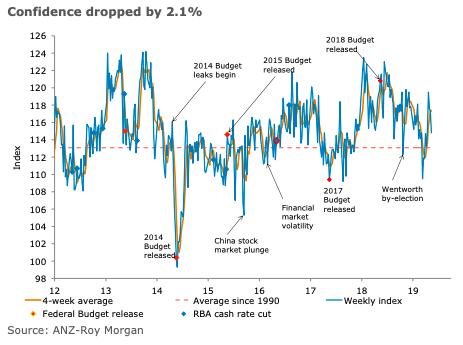

Australia’s ANZ-Roy Morgan consumer confidence fell by 2.1 percent last week, closing below its four-week moving average but remaining above the long-term average.

Financial conditions were not the cause of the fall, with current finances up 2 percent, while future finances rose 1.4 percent.

Economic conditions dropped sharply, however, with current economic conditions down a massive 8.1 percent, continuing their recent volatile pattern, and future economic conditions falling 3.3 percent.

The 'time to buy a household item' also did not help, falling 2.5 percent. The four-week moving average for inflation expectations rose by 0.2ppt to 4.2 percent.

"The fall in consumer sentiment follows a couple of important developments. Domestically the RBA decided to leave interest rates unchanged after considerable speculation that a rate cut might occur. Globally, the US-China trade dispute resumed with the US increasing tariffs on a wide range of goods. At this stage, consumers see these events as more damaging for overall economic prospects than their own finances. After a period of weakness, inflation expectations jumped to 4.5 percent for the week, pushing the four week moving average to 4.2 percent – its highest level since the end of January. The uptrend in petrol prices over the last few weeks may have supported inflation expectations," said David Plank, ANZ’s Head of Australian Economics.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength