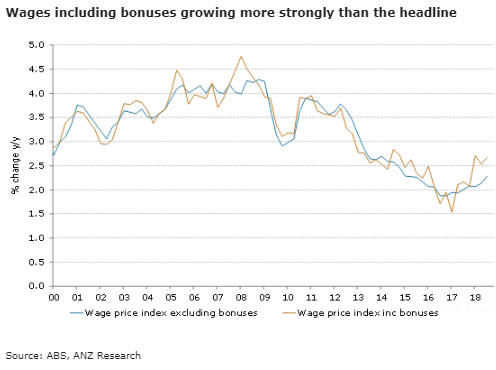

Australia’s wage price index for the third quarter of this year rose to its highest in three years, while the AUD/USD currency traded range-bound at the time of writing during Asian session Tuesday. Further inroads into unemployment and underemployment are necessary preconditions for a more meaningful uplift in wages, according to the latest report from ANZ Research.

The wage price index (WPI) rose by 0.6 percent q/q and 2.3 percent y/y in Q3, in line with market expectations but a bit softer than we expected, given the recent increase to the minimum wage. Public and private sector wage growth both rounded to 0.6 percent q/q, but in annual terms public sector wages pulled ahead to 2.5 percent y/y versus 2.1 percent y/y for the private sector.

Across industries, miners continue to experience the (equal) weakest wage growth at 1.8 percent y/y, although this accelerated from the previous quarter (1.3 percent y/y). Retail wages were also only up 1.8 percent y/y, though this was also an acceleration (from 1.5 percent y/y).

Wage growth accelerated in most sectors, with construction the only one to show a (modest) slowdown. Wages are growing fastest in health (2.8 percent y/y), education (2.7 percent y/y) and utilities (2.7 percent y/y) and are slowest in mining and retail (1.8 percent y/y), rental & real estate (1.9 percent y/y) and construction (1.9 percent y/y).

Across the states, wages in Western Australia (+1.6 percent y/y) and the Northern Territory (+1.7 percent y/y) remain the weakest, though they are picking up. Tasmanian workers are still enjoying stronger wage rises than their mainland counterparts (+2.6 percent y/y), with especially solid growth in private sector wages (+2.8 percent y/y).

Meanwhile, public sector employees in Victoria continue to enjoy the strongest wage gains (+3.3 percent y/y). At the time of writing, AUD/USD traded 0.03 percent lower at 0.7216.

Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs

Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs  U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings

U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order

China and Uruguay Strengthen Strategic Partnership Amid Shifting Global Order  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Japan Services Sector Records Fastest Growth in Nearly a Year as Private Activity Accelerates

Japan Services Sector Records Fastest Growth in Nearly a Year as Private Activity Accelerates