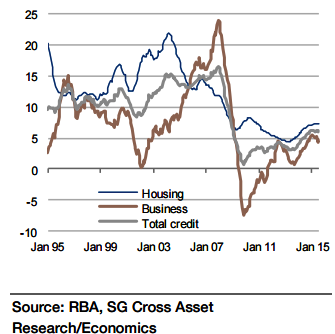

The sharp slowdown in Australia's credit growth in July to 0.6% mom from an average of 0.9% mom over the previous 12 months looks to us erratically weak. Underlying growth momentum in Australia's private sector credit is driven by essentially three factors, one, low interest rates, which are encouraging all forms of borrowing, but especially for home purchases, be it for owner-occupation or investment purposes.

However, one use of credit, for 'other personal' loans, appears impervious to the interest rate lure, suggesting that outside of mortgage debt, households remain quite cautious about credit. Macroprudential measures (including higher interest rates for housing investors but mostly supply limits) which are now beginning to weigh on investor demand.

"A pick-up is expected in growth in this segment to around 0.75% mom. Still, growth is likely to slow over the coming months to around 10% from 10.8% currently, as banks bow to APRA's threats if this rate is exceeded", says Societe Generale.

The much-weakened exchange rate, reasonably firm consumption growth and tax breaks for small business investments have in our view contributed to more dynamic credit demand from non-resource companies.

"However, the 0.7% mom jump in July probably overstates the underlying momentum, so a more subdued reading is likely in August (0.3% mom). All in all, a slight acceleration in credit growth is expected to 6.2% yoy from 6.1%, a rate that is moderate by Australian standards, but well above current nominal GDP growth", added Societe Generale.

Australia's credit growth likely stabilising at a healthy rate

Monday, September 28, 2015 6:53 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022