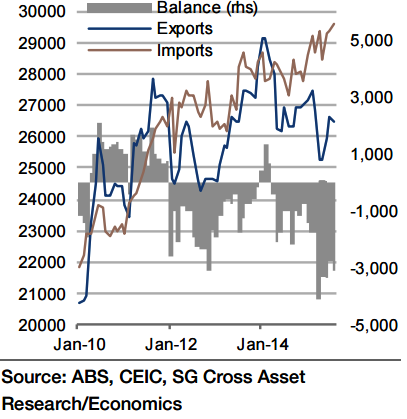

Australian goods imports were strong and the ABS advanced estimate is also positive in September at 1.4% mom, any decline in the trade deficit will be decisively limited by this.

The overall imports are likely a bit less dynamic, might be because services imports were soft for some time and with the weak exchange rate, it is unlikely to change in near term.

Also, the exports might have recovered from August dip, partly due to iron ore price improvement in August and September, when measured in AUD. This should offset coal prices which are slightly lower.

"September data completes the Q3 numbers, confirming a negative contribution to Q2 GDP growth, while net exports edged up in Q3. Q3 average July/August exports were higher than that of Q2's average, and imports rose 1.6%", says Societe Generale.

Adding to it, flatness is seen in export prices, while there was a rise in import prices, which means export volumes probably climbed 4-5% qoq with imports rising just 0-1%.

Australia's trade deficit likely elevated by strong imports, while net exports still recover

Wednesday, November 4, 2015 4:50 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed