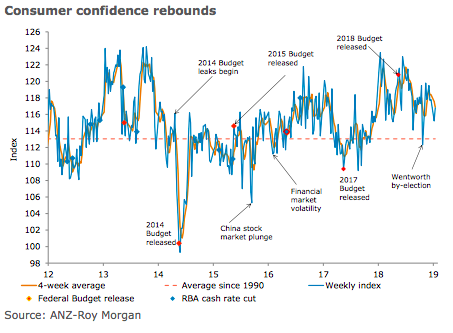

Australia’s ANZ-Roy Morgan consumer confidence was up 1.4 percent last week. Current financial conditions were up 2.8 percent, rebounding after three consecutive falls.

Future financial conditions registered the fifth consecutive increase, rising 2.0 percent. Economic conditions declined, with current and future economic conditions falling by 0.6 percent and 2.3 percent respectively.

There was a marked improvement in the ‘time to buy a household item’ index, with it registering 3.9 percent growth. This took the index to its highest level since the first half of October and above the long-run average. Four-week moving average inflation expectations were stable at 4.3 percent.

"Consumer confidence was up 1.4 percent last week thanks to a good showing from the ‘financial conditions’ and ‘time to buy a household item’ indices. This increase reverses a good portion of the decline captured in the first survey of 2019 and consolidates consumer confidence at a level comfortably above the long-run average. The resilience shown by Australian households amidst weak global and domestic cues is encouraging. Robust job vacancies data may have played a role," said David Plank, ANZ’s Head of Australian Economics.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom