In our previous post we discussed on ailing Australian economy and reiterated our bearish outlook. This view of weakness is also shared by the Reserve bank of Australia, which sought to further monetary easing path. In this context we maintain our bearish view and yet present another set of data to strengthen our argument, the terms of trade.

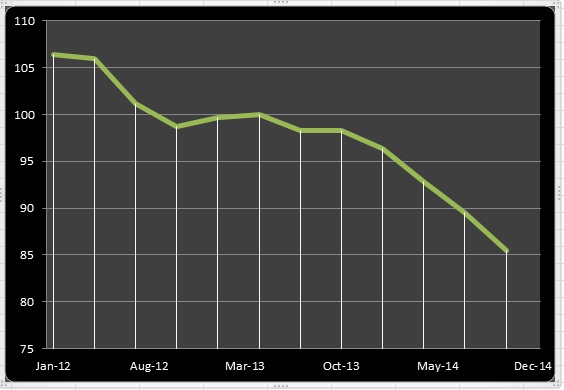

- Terms of trade represents the ratio of export and import prices. The ratio is falling fast in recent times. We expect further sluggish data ahead and Australia's trade advantage to reduce further.

- Australian economy is suffering the headwinds from the falling commodity prices and slowing down in China and Europe.

The ratio so far has deteriorated nearly 20% since 2012. We have seen reflection of such in AUD/USD rate. The pair is currently trading at 0.78. We remain bearish despite any short term bounce. 0.80 area is importance resistance zone.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?