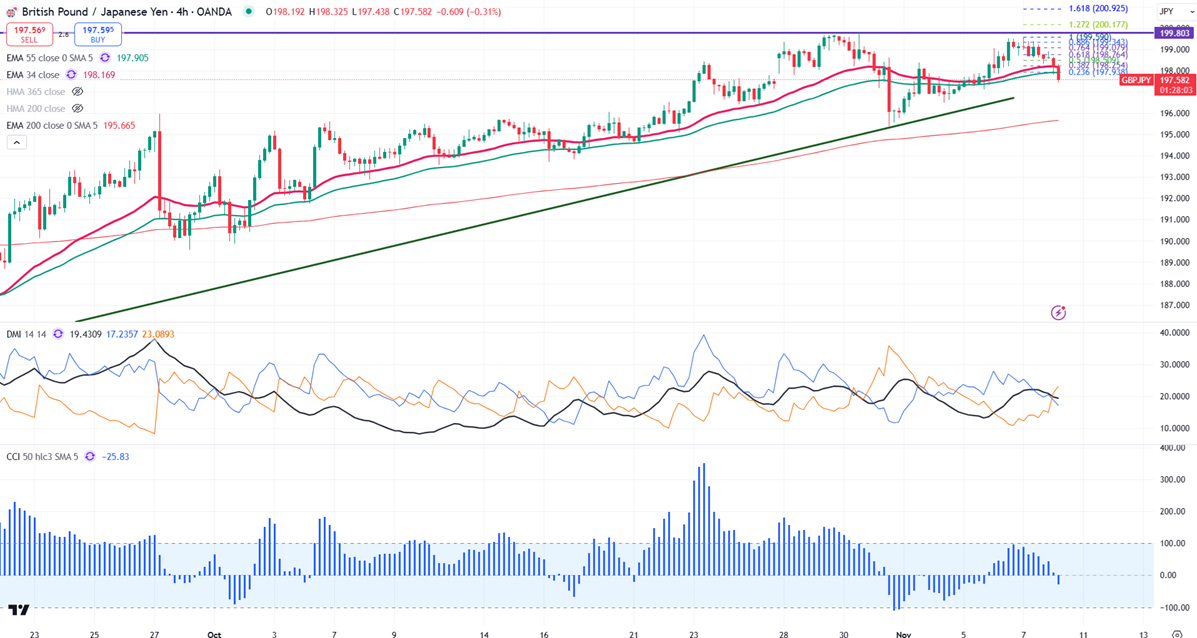

The GBP/JPY currency pair lost most of its earlier gains after decisions made by the Bank of England (BoE). It dropped to a low of 197.43 and is currently trading around 197.53. The Potential Reversal Zone (PRZ) is set at 200.20.

The BoE has lowered interest rates from 5% to 4.75%. This decision was made by most members of the Monetary Policy Committee, while one member wanted to keep the rates the same. This is only the second time rates have been cut since 2020. The cut is happening because the government expects inflation to increase and the economy to grow. Governor Andrew Bailey emphasized the need to be careful with future cuts to keep inflation close to the target of 2%.

Japanese officials have stepped in verbally to prevent the yen from declining further.

Technical Overview:

The GBP/JPY is trading below both short-term and long-term moving averages, which suggests a downward trend. The immediate resistance level is at 198.25. If the price breaks this level, it could rise toward 198.76, 199.60, or even 200.20. Support is at 197, and if that fails, the price could drop to 196.50 or 195.40.

Indicator Analysis:

The CCI and ADX indicators suggest a neutral trend right now.

Trading Recommendation:

Consider selling if the price rallies to around 198.55-60. Set a stop-loss of around 200 and aim for a target price of 195.50.