After a string of Canada's disappointing activity data for the early part of Q2, what tipped the scale is a very weak April GDP print and a May trade report that clearly runs against the BoC's expectation of a rebound beginning this quarter.

There might be no growth or close to no growth this quarter, which would be a big disappointment to the BoC's current projection of 1.8%q/q ann. Furthermore, the part of the economy that was expected to be most buoyant non-energy exports has not improved. Not only that, but net trade is now pointing toward being a drag on growth this quarter, and that is a big knock to the Bank's rotation story.

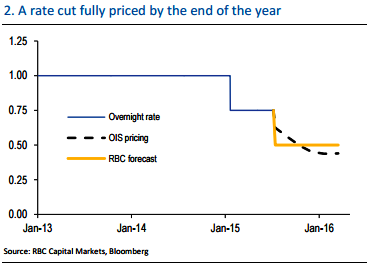

"Next week's BoC meeting might call for a rate cut and the Bank is expected to opt for a 25bps cut to the policy rate", forecats RBC capital markets.

That certainly warrants some additional caution from the BoC, and it's enough to see them cut the policy rate as soon as the July 15th meeting. A cut next week is a very close call, and the market reflects that with OIS showing the probability of a cut at about 50%. Looking further out the curve, though, shows a market more confident of a cut by the end of the year.

Bank of Canada to cut rates

Friday, July 10, 2015 7:25 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed