The Bank of Mexico has kept its policy rate unchanged since mid-2014 at 3.0% - historically its lowest level - and no rate hikes are expected until Q1 2016 given the persistent output gap and low inflation. Progress on three fronts could affect the timing of Banxico's first rate hike.

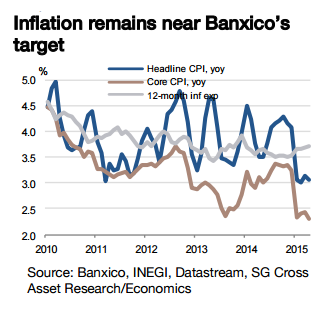

The first factor relates to growth and employment, which had led the bank to cut rates significantly in this cycle. An output gap persists in the product market, while there is still significant slack in the labour market. Secondly, inflation is close to Banxico's target despite the significant depreciation of the peso, and core inflation and year-ahead expectations suggest no immediate and significant threat on this front. The third factor is the timing of the beginning of the Fed's tightening cycle, which could increase financial market volatility and put further pressure on the peso, necessitating an adequate policy response by Banxico.

Banxico to stay on pause until Q1 16

Tuesday, July 28, 2015 12:59 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022