A brief historical snapshot:

Commodities are experiencing what has already been the second-deepest and longest bear market of the past 45 years, with a decline from their peak of over 55% over the past 4.5 years.

Only the post-Lehman plunge was steeper (61% peak-to-trough), and only the 1981-86 one longer (5.5 years).

From their 2011 peak, four commodities have depreciated at least 50% currencies (ARS, BRL, RUB, ZAR), and five others are down about 30% (NOK, AUD, COP, CLP, MYR).

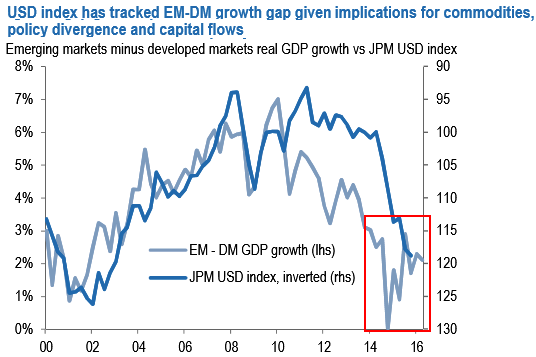

The major key drivers of these ongoing declines are well understood - China's industrial slowdown, rising commodity supply in every sector and almost every region but US shale, and interest rate cuts in most commodity-exporting countries (except Russia, South Africa, Brazil and Colombia).

OPEC disappointed oil price stability, as the high level of production was continued, which has led the market oversupplied, the condition likely to stabilize only during H1 of 2016.

As a result, the CAD, BRL and NZD the have led declines against the U.S. dollar.

The Lonnie has taken a deep hit from declines in oil, iron, aluminum and gold. Outlook for 2016 - supply glut to decline - This will reduce the oversupply during the course of next year, which we believe will spark recovering prices.

Ruble was suffered for being world's biggest exporter of natural gas and a major producer of gold and coal.

Major hits from base metals that dragged currencies are: Iron ore for AUD and BRL, copper for CLP, dairy for NZD - supply growth in 2016 will be below the peak rates of the past few years but still too strong to tighten market balances when China demand is so weak.

For example, global iron ore supply to grow at 1.6% versus 0.7% in 2015, and copper production to expand at 1.8% versus 0.7% in 2015.

But even these below-trend pace shouldn't be sufficient to lift prices given that China's industrial cycle explains over half the variation in these prices, such that every 1% change in Chinese industrial production growth is worth about 7-10% moves in prices.

Thus we expect 2016 to be a year of price divergences across commodity sectors by which the price of oil and natural gas rise but those of copper fall (end-2016 target of $4000/tonne) and those of iron ore remain depressed but range-bound around current levels ($45/tonne).

Hence, it is understood that Divergence in currencies suggests a stronger dollar, weaker commodity currencies and hence lower production cost.

Base metals and oil hit toll on commodity driven currencies – a bird’s eye view of impact of supply cycle shrink in demand on FX market

Friday, December 11, 2015 9:54 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings