At European leaders meeting on February 18th and 19th, there is scope for an agreement to be reached over the renegotiated terms of Britain's EU membership, clearing the way for a referendum in June. If the UK were to decide to leave the European Union it would be a negative event both for the UK economy and the rest of the European Union. On the other hand if the UK stays in the EU and the UK economy could see a post-referendum bounce in confidence.

A YouGov poll showed 45 percent of Britons would vote to leave the bloc compared with the 36 percent who want to remain. The sterling is definitely set for a rocky ride in the next few months. The pound has fallen about 8 per cent since Nov on a trade weighted basis on account of the uncertainty surrounding the Brexit vote. There are fears that a potential Brexit could spark a recession.

Uncertainty stemming from the referendum is likely to keep the pound choppy in the coming months. This weakness is not just on account of reduced expectations of rate increases by the Bank of England; the pound has fallen against the euro, as well as the dollar, even though the European Central Bank has indicated that it will probably ease monetary policy.

"BoE minutes and the quarterly reflation report leave the impression that there is no rush hiking rates. Finally, mixed economic signals suggest that the fiscal tightening works now in a pro-cyclical way." says BoFA Merrill Lynch in a research note.

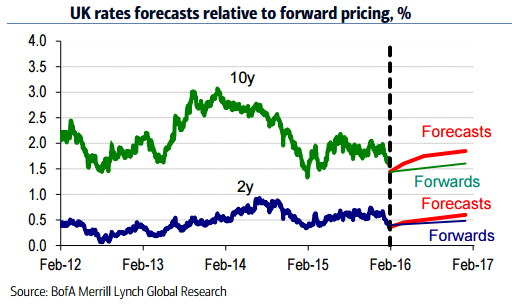

A number of factors support the bearish outlook for Gilts in 2016. Irrespective of the outcome, the Brexit risk is seen as Gilt bearish and analysts believe the strong overseas demand for Gilts seen so far this fiscal year could soften as we head into the referendum. Heading into the end of this fiscal year there are risks of fiscal slippage prompting a need for greater Gilt financing need next year.

"We are mildly bearish Gilts relative to the forwards and we maintain our short Gilts versus Bunds recommendation", adds BoFA Merrill Lynch.

UK Gilts opened 31 ticks higher than the settlement of 121.21 as core markets drew support from the FOMC minutes which watered down their recent hawkishness. The 10-year cash yields were operating in a 1.441% to 1.458% range. The yesterday's high on 10-year cash yields at 1.504% will act as resistance with support coming from recent lows around the 1.42% region.

Bearish outlook for Gilts in 2016

Thursday, February 18, 2016 11:29 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate