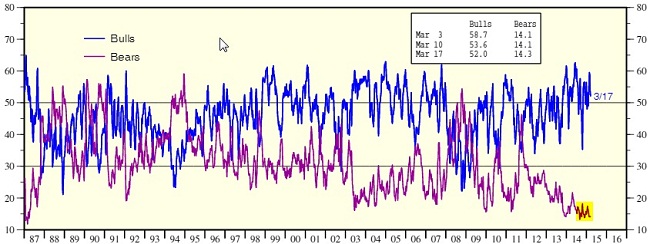

Successive quantitative easing by different central banks across world namely FED, ECB and BOJ have driven bullish sentiment to such extreme that bears are in fact gone missing in the market. Chart courtesy sober look.

- Detailed position is explained in the chart, current percentage of bullish investors stands at 52% as of March 17, whereas bears stands at 14.3. Bullish investors have been reduced from 58.7 in March 3. However fall in S&P500 prior to FOMC, failed to attract the bears in market.

- Bearish investor proportions as of now has fallen close to levels last seen in 1987, prior to the stock market crash.

Analogy -

- Stocks might have enough room to benefit from increased economic activities and easing by other central banks, however investors should remain cautious over such one sided sentiment.

- If history is of any guide then stock markets, then stock markets remain very vulnerable to such one sided sentiments and to extreme level.

- Bears have tendency to hold grip over market fairly rapidly unlike bulls. Historically speaking, bearish investor proportions rose in 1987, from just below 10% to 55% within a year. Similar can be said for 2008 great recession or 2011 Euro zone crisis.

Extreme bullish sentiments might further drive the bears away, however caution is the word and need to be exercised by investors, especially for the new and first timers.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings