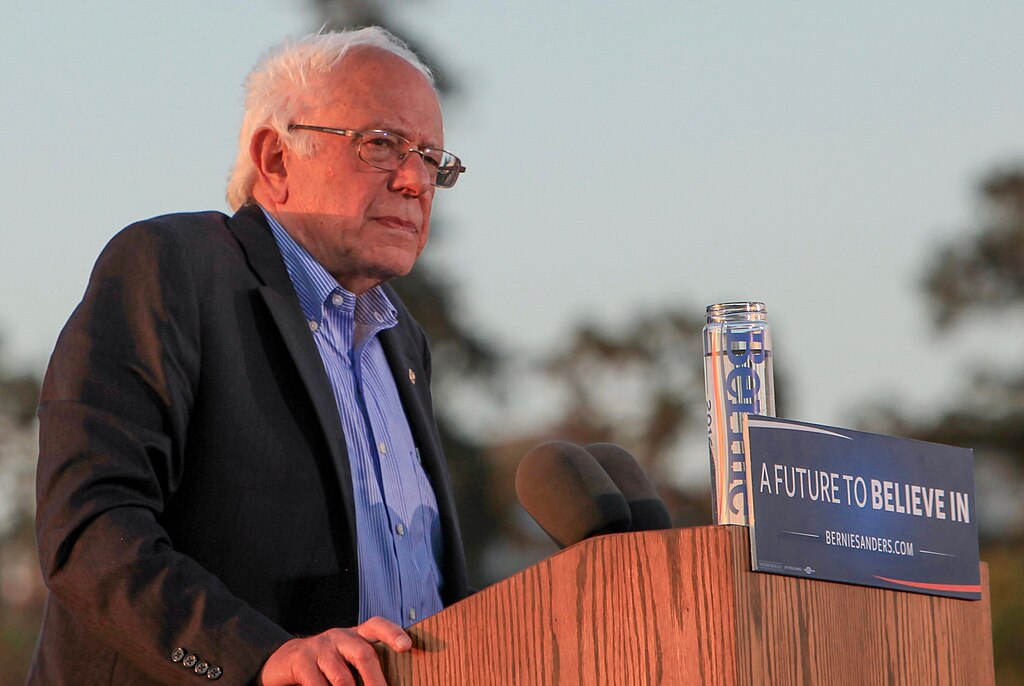

In a move that has surprised both political insiders and everyday Americans, Senator Bernie Sanders has expressed his willingness to work with President-elect Donald Trump to tackle excessive credit card interest rates. Sanders, a long-time advocate for financial reform, aims to cap credit card interest rates at 10%, a measure he argues is long overdue to protect consumers from predatory lending practices.

The announcement has sparked intense debate, as it marks one of the first instances of bipartisan agreement between Sanders, a self-described democratic socialist, and Trump, a polarizing conservative figure. The collaboration highlights a shared concern over what both see as the exploitation of working-class Americans by major financial institutions.

A Common Enemy: Big Banks

The financial industry, particularly credit card companies and large banks, is the central focus of the proposed reform. Sanders has criticized institutions that charge Americans interest rates of up to 30% on credit cards, while raking in record-breaking profits. Trump’s administration, according to insiders, is reportedly open to Sanders’ proposal as part of a broader effort to address economic grievances among working- and middle-class voters.

Sanders has long advocated for stricter regulation of financial institutions, and this plan aligns with his previous calls to end what he describes as “unbridled corporate greed.” For Trump, the initiative is seen as a populist strategy to maintain support from voters who are increasingly disillusioned by financial inequality.

Criticism and Controversy

While the collaboration between Sanders and Trump has been lauded by some as a rare example of bipartisan cooperation, it has also drawn criticism from both ends of the political spectrum.

Progressive activists have expressed skepticism, fearing that Trump’s administration may not fully commit to the necessary regulatory measures to enforce such a cap. Meanwhile, conservatives argue that government interference in setting interest rates could stifle competition and hurt financial institutions.

Big banks, predictably, have pushed back against the proposal. Industry leaders warn that a cap on interest rates could lead to reduced credit availability for consumers, especially those with lower credit scores, effectively penalizing the very individuals the measure aims to protect.

A Historic Financial Reform?

If enacted, a 10% cap on credit card interest rates would represent one of the most significant consumer protection measures in recent history. For millions of Americans burdened by high-interest credit card debt, the reform could provide much-needed relief. However, the logistical challenges of implementing such a cap and the potential economic consequences remain points of contention.

As Sanders and Trump prepare to tackle the financial sector, their partnership underscores the growing frustration with an economic system that many Americans feel is stacked against them. Whether this collaboration will yield tangible results or fizzle out amid political and industry resistance remains to be seen.

The Road Ahead

Sanders and Trump’s shared focus on credit card interest rates may signal a broader shift toward populist financial reforms. However, the question of whether their alliance can overcome entrenched corporate interests looms large. For now, their bipartisan push has reignited national conversations about fairness and equity in the U.S. economy.

Argentina Senate Approves Bill to Lower Age of Criminal Responsibility to 14

Argentina Senate Approves Bill to Lower Age of Criminal Responsibility to 14  Denver Mayor Orders Police to Protect Protesters, Restricts ICE Access to City Property

Denver Mayor Orders Police to Protect Protesters, Restricts ICE Access to City Property  Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors

Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors  Netanyahu Suggests Iran’s Supreme Leader Khamenei May Have Been Killed in Israeli-U.S. Strikes

Netanyahu Suggests Iran’s Supreme Leader Khamenei May Have Been Killed in Israeli-U.S. Strikes  Iran Supreme Leader Ayatollah Ali Khamenei Killed in Israeli, U.S. Strikes: Reuters

Iran Supreme Leader Ayatollah Ali Khamenei Killed in Israeli, U.S. Strikes: Reuters  Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit  Philippines, U.S., and Japan Conduct Joint Naval Drills in South China Sea to Boost Maritime Security

Philippines, U.S., and Japan Conduct Joint Naval Drills in South China Sea to Boost Maritime Security  Australian PM Calls Alleged Western Australia Terror Plot “Deeply Shocking” After Arrest

Australian PM Calls Alleged Western Australia Terror Plot “Deeply Shocking” After Arrest  Trump Launches Operation Epic Fury: U.S. Strikes on Iran Mark High-Risk Shift in Middle East

Trump Launches Operation Epic Fury: U.S. Strikes on Iran Mark High-Risk Shift in Middle East  U.S.-Israel Strike on Iran Escalates Middle East Conflict, Trump Claims Khamenei Killed

U.S.-Israel Strike on Iran Escalates Middle East Conflict, Trump Claims Khamenei Killed  Pentagon Leaders Monitor U.S. Iran Operation from Mar-a-Lago

Pentagon Leaders Monitor U.S. Iran Operation from Mar-a-Lago  Trump Floats “Friendly Takeover” of Cuba as Rubio Reportedly Engages in Talks

Trump Floats “Friendly Takeover” of Cuba as Rubio Reportedly Engages in Talks  Federal Judge Blocks Virginia Social Media Age Verification Law Over First Amendment Concerns

Federal Judge Blocks Virginia Social Media Age Verification Law Over First Amendment Concerns  Pakistan-Afghanistan Tensions Escalate as Taliban Offer Talks After Airstrikes

Pakistan-Afghanistan Tensions Escalate as Taliban Offer Talks After Airstrikes  Israel Launches Fresh Strikes on Iran After Death of Supreme Leader Ayatollah Khamenei

Israel Launches Fresh Strikes on Iran After Death of Supreme Leader Ayatollah Khamenei  Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology

Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology  Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement

Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement