Oil price has rebound sharply after fall interest rate and economic projection by FOMC participants led to short term dollar demise.

Rebound in oil and sharp decline in number of oil rigs in US raised the possibility that the price of oil has bottomed and now is the turn to rise.

In spite of the speculation any big rebound or trend reversal is very unlikely.

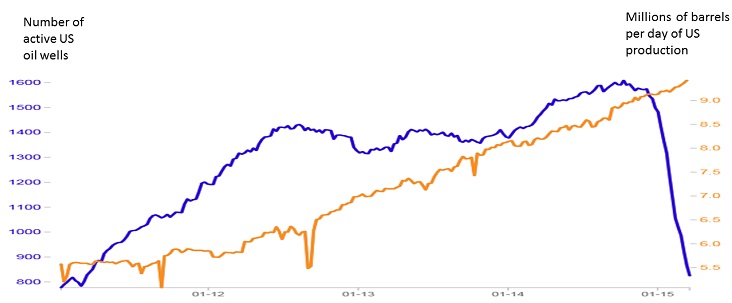

- Production has gone up despite 46% fall in active rigs. This provides evidence that efficiency of production has increased significantly. Companies now focusing on wells with higher margin may sustain the fight for long. Chart courtesy ICIS, an intelligence provider in petrochemical industry.

- Kuwait officials in recent comments reiterated Saudi Arabia's view and shrugged off any production cut. This means more supply.

- US lawmakers have yet not lifted the ban in crude export but that option can't be completely rules out once a new government takes the Whitehouse in 2016 race. Supplying oil and gas to Europe is quite lucrative to reduce the influence of Russia over the region. Spreads might tighten but overall supply of Crude will increase.

- Partial nuclear deal is possible in Iran by March 31, which will lead to additional supply of at least 1-2 million barrels/day.

- Commentaries from China, suggests demand is still lackluster. Other big Asian consumers like Japan, South Korea, and India all reduced their intake despite lower prices.

WTI crude is trading at $48/barrel at a discount of $8.5/barrel against Brent.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate