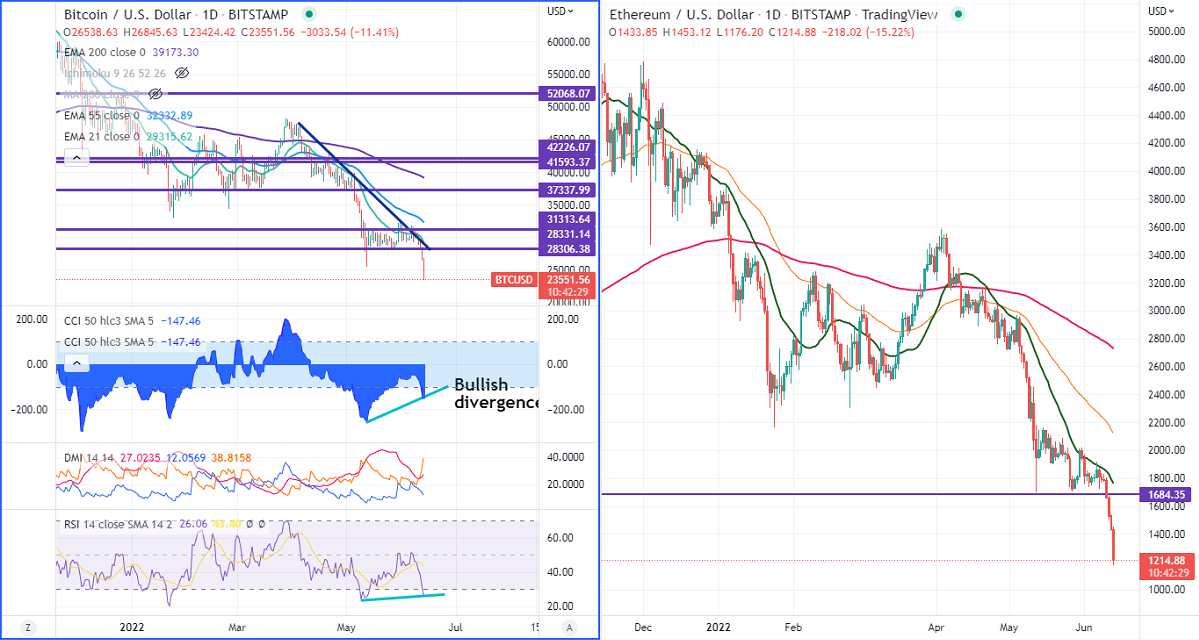

Chart pattern- Bullish divergence

BTCUSD slumped sharply after US CPI data. . It came at 8.6% in May compared to a forecast of 8.3%, the largest YOY increase in 40 years. Celsius network negative news also dragged crypto down further. The largest crypto lenders have paused all withdrawals and transfers due to extreme market conditions. Intraday low of $23750 and is currently trading around $23889.

Bear case-

Levels to watch- $23500. Any violation below will drag the pair to the next level to $21980/$20000.

Bull case-

Primary supply zone -$25810. The breach above confirms minor bullishness. A jump to the next level of $28500/$30000 is possible.

Secondary barrier- $32500. A violation above that barrier targets $37000/$40000.

CCI (50) holds above the zero line in the 4-hour chart.

It is good to buy on dips around $23000 with SL around $21980 for TP of $30000.

Ethereum (ETHUSD)-

ETHUSD continues to trade weak, following in the footsteps of BTC. It hits an intraday low of $1175 and is currently trading around $1217.90.

Bear case-

Levels to watch- $1168. Any violation below will drag the ETH to near-term support of $1000. Major demand zones are $1000. A breach below targets $880.

Bull case-

Primary - Barrier- $1360. Any breach above confirms an intraday bullishness. A jump to $1410/$1500/$1600.

Secondary barrier- $1700 (support turned into resistance). A breach above that barrier targets $2000/$$2160.

It is good to buy on dips around $1170-75 with SL around $1000 for TP of $1600.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary