Bank of England indicated that it is not in hurry to raise the rates till 2016, seems like UK's interest rates are set to remain at their lowest levels comfortably till next year. The bank was unexpectedly dovish in signalling about the rate hike, the MPC voted 8-1 for keeping rates on hold.

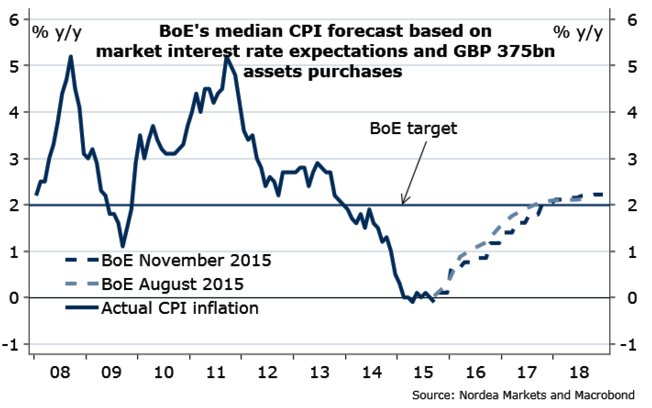

The Monetary Policy Committee voted unanimously to maintain the purchased assets stock financed by the central bank reserves, which is at GBP 375bn. The central bank sounded more cautious about the country's growth and inflation outlook , compared to previous meetings.

BoE opined that albeit the domestic economy is strong, there are uncertainities from external shocks like the risks from EM, lower fuel prices, imported goods and food might drag down the inflation levels below 1% through next year, also till 2017.

The current market rate anitcipations of the central bank being on hold till 2016 leads the committee not to expect inflation to exceed 2% until Q1 2018, also signalling the calmness of the bank in veiw of tightening.

"Overall, today's BoE data deluge and unexpectedly dovish signals raise the risk of delayed BoE tightening compared to our call for a first rate hike in Q1 2016. The chance of a delay in lift-off in BoE rates until Q2 2016 is now higher", says Nordea Bank.

BoE's surprisingly dovish 'Super Thursday'

Friday, November 6, 2015 5:12 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty