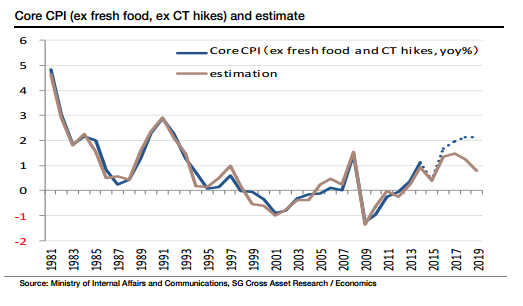

The market is doubtful about whether the Bank of Japan's 2% inflation target will be achievable around the first half of fiscal 2016. The key factors that determine CPI are aggregate wages (domestic pressure), US CPI (external pressure), and the USD/JPY. CPI modelling based on these key factors shows that 2% inflation requires a 4% rise in aggregate wages, 2.5% inflation in the US, and the USD/JPY at around 135. The 2% target can be achieved in the short term; however, the obstacles to reaching it appear very high.

The negative constant in the CPI modelling equation indicates that a deflationary expectation is deeply ingrained in the Japanese economy. A move in the right direction would be a shift to a strong inflationary environment instead of the current deflationary environment. In other words, the constant needs to change from a negative to a positive number through upward pressure on inflation expectations. For this to happen, wage increases should lead to inflation, further pushing up wages.

"We find it difficult to achieve stable 2% inflation in the short term under current situation, but in the longer term (probably by FY18), it is achievable," says Societe Generale.

BoJ’s 2% inflation target could take a long time to achieve

Monday, August 10, 2015 2:26 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX