Bond market is not where one usually finds lots of volatility, however that may not be the case this year.

- Bond market is experiencing an unusually high volatility this year and by one measure it is on its way to become most volatile since 2009.

Massive amount of asset purchase by US Federal Reserve, along with other central banks around the world had suppressed volatility and yields in recent years, making investors chase for yield and making investments into assets at much lower yields than they would ask normally if the market condition is volatile.

Higher the volatility, worse the risk reward ratio for those low volatility environments. Reversal of some of the bets have already started creating havoc across emerging markets.

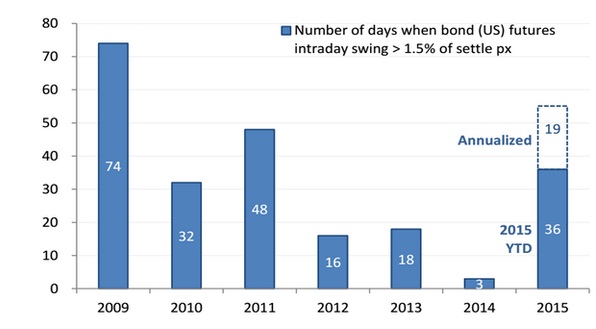

The chart from Deutsche bank, shows one measure of volatility in the bond market and an intra-day one.

As of now this year, there has been 36 days, when price made swings more than 1.5% intraday of final settlement price, which is already highest since 2011. By the same measure, last three years has been of very low volatility, with average days standing around 12.

- In our view, since lot of bond market liquidity being sucked by central banks in past few years, there would be lot of volatility in that market as policies reverse.