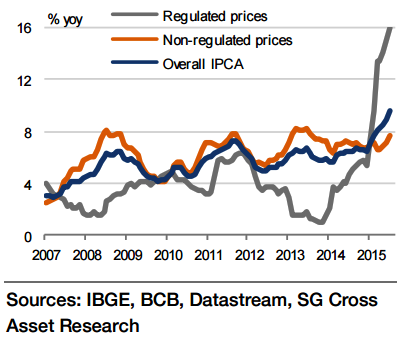

While Brazil mom prices rose 0.62% in July, less than the 0.79% mom in June, annual inflation jumped to 9.56% yoy from 8.89% yoy in June. The acceleration was quite broad-based with the mom rate of price change exceeding their respective values from the same month last year in six out of nine major spending categories.

This comparison is worth mentioning to negate the effect of seasonality and suggests that inflation is also being driven by structural factors (such as high unit labour costs, BRL depreciation and structural bottlenecks), quite apart from the rise in administered inflation and the slightly surprising increase in food inflation.

Among the key segments, food inflation (10.5% yoy) entered double-digit territory after nearly two years, while housing inflation (18.3% yoy) soared to its highest level in more than a decade and transport inflation (8.6% yoy) was the highest seen since 2006.

"The recent movement in the components and the initial weekly releases of other price indicators lead to project mid-month IPCA-15 inflation at 9.72% yoy in August. The aforementioned factors mean upside risks to the near-term inflation outlook have risen further above our revision to the inflation forecasts. In fact, based on the current pace of acceleration, we estimate full-year inflation to exceed 9.0% yoy in 2015. The in-sample forecasts from our structural inflation models put Q2 inflation at 7.0-7.2%, i.e. much lower than the observed inflation", says Societe Generale.

The additional inflation may be attributed to the effect of price adjustments and the upside shock to food prices. However, while escalating upside risks imply that the medium-term inflation outlook remains considerably uncertain, the model estimates appear to fundamentally confirm a continued surge in trend inflation.

"Both these factors and the significant pressure on the BRL mean an upside risk to the forecast that the Selic rate will peak at 14.50% in Q3 15 despite the change in the BCB's language at the last Copom", added Societe Generale.

Brazil inflation acceleration continues in Q3

Monday, August 17, 2015 6:01 AM UTC

Editor's Picks

- Market Data

Most Popular

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector  China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength

China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength  Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion

Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion  Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty

Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty  Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility

Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility  Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears

Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears  KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking  Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion

Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion  U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns

U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns