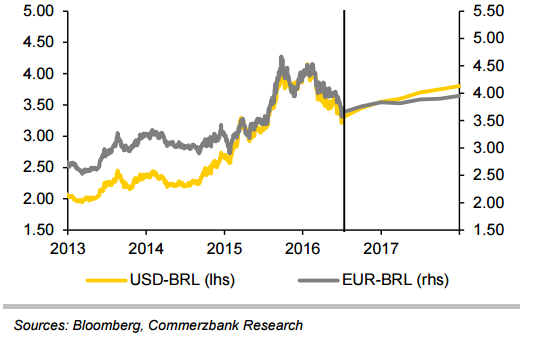

The Brazilian real has appreciated 20 percent against the US dollar so far in 2016. The strengthening of real is mainly due to the muted outlook of the US Fed’s interest rate and also due to markets pricing that the new Brazilian government is expected to execute austerity cuts, noted Commerzbank in a research report. But if the Central Bank of Brazil begins with a rate cutting cycle, if will lower the attractiveness of the Brazilian real in the medium term.

Meanwhile, persistent poor fundamentals argue that the Central Bank of Brazil would not want extreme appreciation of the Brazilian real. The USD/BRL pair is expected to trade towards 3.55 by the end of this year, according to Commerzbank.

Brazilian real’s rally unlikely to sustain

Wednesday, July 13, 2016 1:01 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022