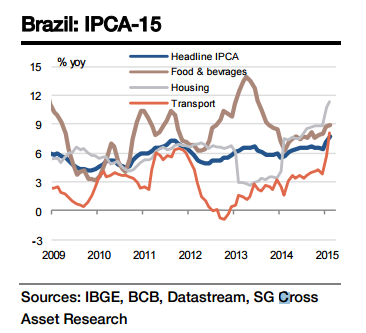

After hitting 7.14% in January due to the rise in the administered prices of electricity andenergy, inflation rose further in February to 7.70% yoy primarily on account of the continued rise in transport prices (8.1% yoy versus 5.7% in January) and an acceleration in housing (11.3% yoy) and food (9.0% yoy) inflation.

However, the key factor behind monthly inflation in February was the seasonal rise in education prices (5.9% mom), which contributed about onefifth (0.26pp) of total inflation (1.2% mom).

Societe Generale notes the following in a report on Monday...

- We expect IPCA-15 inflation to accelerate to 7.68% yoy (implying virtually no change in inflation against the IPCA full-month series).

- There is a considerable probability that inflation in 2015 could come in higher than our current forecast of 7%.

- Moreover, it's likely that inflation stays above 7% throughout the year and subsides only in 2016.

- Our forecast for moderation in 2016 is based on the fading effect of recent changes in energy prices, continued low growth and monetary policy tightening.

- However, there remains considerable upside risk to 2016 inflation if the labour market doesnot deteriorate enough in response to low growth, leading to second-order impacts on pricesin 2016.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed