Growth weakness at home is helping on the external front of Brazil although export growth probably remains under pressure (at least in dollar terms). Going forward, gains on the export front is expected given the considerable depreciation of the BRL. As a result, the current account could be heading for a substantial correction this year in dollar terms. However, given the possibility that BRL depreciation this year could be over 30%, therefore, only a modest improvement in the current account balance to GDP ratio is likely to seen, says Societe Generale.

Moreover, the steep pace of decline in imports continues to indicate a serious deterioration in investment demand back home. A sustained improvement in the current account balance must be associated with continued improvements in exports. It remains to be seen whether BRL depreciation over the past year is sufficient to boost the competitiveness and growth of Brazilian exports to the extent needed to improve investment prospects.

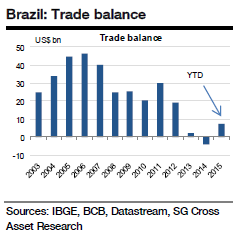

While year-to-date (YTD) Brazil's merchandise exports contracted 16.6% yoy, imports contracted more heavily by 21% yoy. As a result, the YTD trade balance improved from a deficit of -USD952m to a surplus of USD7,296m.

"On our forecast of -USD3,985m for August, therefore, we estimate that the YTD current account balance improved from -USD58.3bn to -USD48.1bn. As is clear from the numbers above, nearly 80% of improvement in the current account balance is driven by the merchandise trade surplus while the rest is driven by trade in services and income categories. This represents a nearly 18% yoy improvement in the current account balance", estimates Societe Genearle.

Brazil's current account improvement continues on falling imports

Tuesday, September 22, 2015 5:37 AM UTC

Editor's Picks

- Market Data

Most Popular

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA  China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump

China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump  Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit  Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute

Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute  Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift

Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift  Asian Stocks Rise on Nvidia Earnings Boost; Yen Weakens as BOJ Rate Outlook Clouds

Asian Stocks Rise on Nvidia Earnings Boost; Yen Weakens as BOJ Rate Outlook Clouds  Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom

Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty

Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty