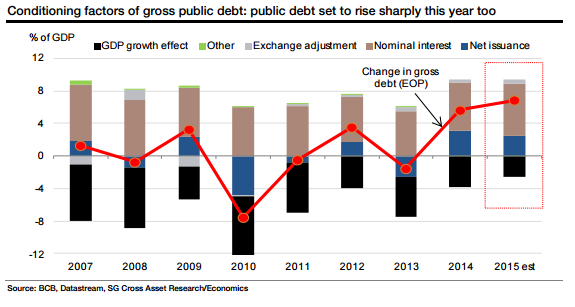

Having risen to 58.9% of GDP in 2014 from 53.3% in 2013 (both based on revised estimates published earlier this year), gross public debt has risen further, to 62.5% in May 2015, although net debt actually fell from 34.1% in December 2014 to 33.6% in May 2015.

A quick look at the conditioning factors of gross debt suggests that each of the key components - issuance, interest payments, exchange adjustment and nominal growth - have worsened year-to-date compared with the 2014 numbers for the same period.

"In a baseline scenario where we expect the government to manage its fiscal house better in H2 than in H1 and the economy to contract less, we estimate public debt could still rise by 6.9 pp this year to 65.8% of GDP (as against our earlier projection of debt rising to 64.5%)",says Societe Generale.

With the fiscal trajectory less clear despite the ongoing austerity efforts and interest rate risks continuing to tilt upwards, the fiscal challenges continue to mount and public debt is not seen falling any time over the next few years. Moreover, rising public debt will likely present fresh challenges to contain interest payments and the overall fiscal deficit.

Brazil's gross public debt could rise by 6.9% of GDP this year to 65.8%

Thursday, July 2, 2015 10:16 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX