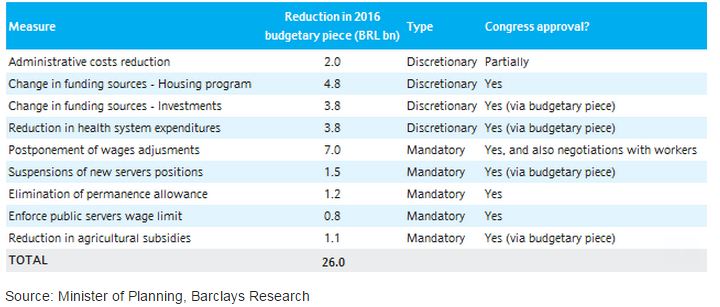

Today, the economic team announced cuts in expenditures and new tax measures, aiming at reaching the 0.7% of GDP primary surplus target for 2016. The cut in expenditures is a necessary (but not sufficient) condition imposed by Congress leaders to discuss a higher tax burden. The measures, however, do not tackle the main issues of the disequilibrium in the fiscal accounts, which are the constitutional increase in expenditures through income transfer programs and the deficit in the social security system.

"We believe that the sources of expenditure cuts will either negatively affect growth further or have a strong pushback in the Congress. This should reduce the probability of voting on measures aimed at higher taxes, probabilities which we believe are already fairly low. In addition, the government is proposing the tax over financial transactions (CPMF); during the past month, we have learned that this will not get many votes," notes Barclays.

If the whole amount of expenditures is approved, it implies a 2.5% reduction in total expenditures in real terms for 2016. Following a 1.7% reduction this year, the cumulative 4.2% proposed reduction in two years looks fairly unrealistic to us. There have only been two years in which expenditures contracted by close figures, 2003 (-3.4%) and 2011 (-3.0%), years when the PT government had an ample political support and the economy was not in a deep recession as it is now.

"The government's lack of credibility is so low that only announcing measures should not be enough to change the market's mood. Despite the economic team's efforts to revert the uncertainties toward fiscal execution, we believe that the risks of approving these changes are very high, given this government's poor political coordination. That said, we stand by our forecast of a deficit of 0.5% of GDP for the public sector fiscal balance," added Barclays.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022