Dollar has taken a major hit last week as speculation over Federal Reserve rate hike faded from June to December. However US benchmark yield are on the rise, in spite of falling dollar.

- As a matter of fact, falling dollar could partially be responsible for rise in rates and inflation expectations.

- Weaker dollar has given rise in price of commodities. Copper is trading around $2.9/pound up from around $2.68, Brent is trading at $67/barrel, and Natural gas has bounced back sharply at $2.74/mmbtu from $2.45/mmbtu.

- Higher commodity prices will provide support to inflation worldwide, should they gain or even sustain at current level, bringing FED closer to its objective.

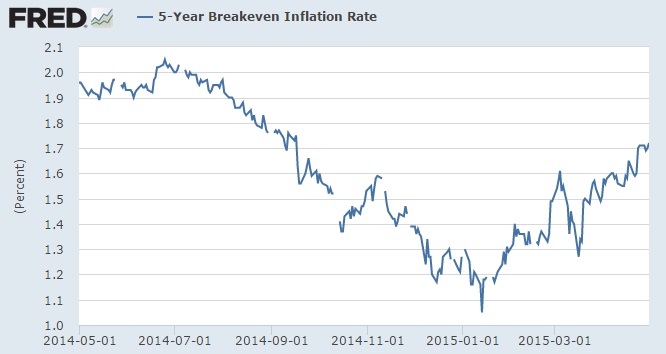

As of last week, 5 year breakeven inflation as measured from inflation protected treasury yields standing at 1.72% up from 1.05% in January and rising steadily. 5 year 5 year forward inflation expectation is close to 2.16%, close to its highest level this year.

As of now, inflation expectation and dollar might diverge but will give to rate hike expectation soon enough pushing treasury yields higher.

Dollar index is trading at 95.46, up 0.25% today so far. Dollar still at current level remains largely exposed to further weakness.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings