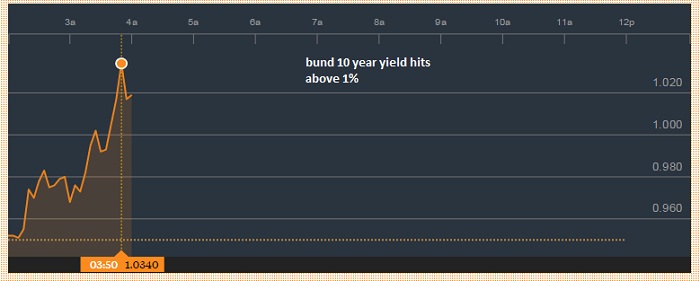

German 10 year bund has finally hit the level and beyond, what many on the market was calling "the magic number" 1% yield.

Euro got the necessary boost from rising yields, though long term yield usually doesn't move currency much. This time though it is different.

- Bund yields which dropped to negative up to 9 years and 10 year dropped as low as 0.5% pushed Euro towards 1.048 against dollar. Unwinding of yields is sure to provide support to Euro.

- Yield curve is now negative only up to 3 years and 3 year yield is on verge of breaking out of negative zone, currently trading at -0.04%.

What to expect now?

Yields are likely to move higher from here at least by another 25 basis points, however it might require support of positive data to move higher. Higher than expected growth and inflation are likely to provide support.

Euro is likely to remain buoyed as long as yield keep rising.

Euro is currently trading at 1.135 against dollar, up 0.5% today so far.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary