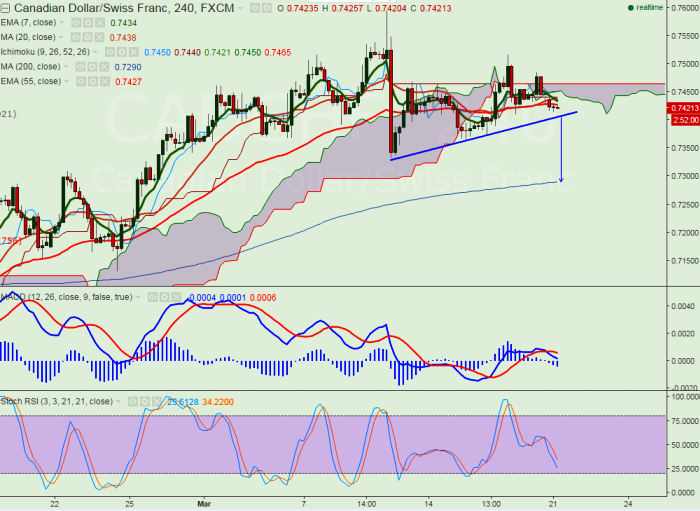

- Major support – 0.7400 (trend line joining 0.7333 and 0.7363)

- The pair has declined till 0.7414 and slightly recovered from that level. It is currently trading around 0.7423.

- Short term trend is weak as long as resistance 0.7465 holds.

- Canadian dollar has been trading weak from Friday on account of weak Oil prices .Crude oil prices declined after making a high $41.18 on account of U.S rig count rose for the first time since December.

- Any break above 0.7465 will take the pair to next level 0.7500/0.75687.

- On the downside any break below 0.7400 will drag the pair till 0.7290.

It is good to sell below 0.7400 with SL around 0.7465 for the TP of 0.7290