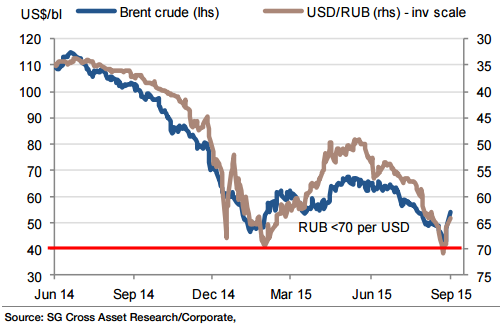

Global risk aversion and the fall in oil prices have pushed the RUB below 70 per USD. The possibility of a rate hike by the Central Bank of Russia is not ruled out and this is caused to initiate a 1y cross-currency payer trade at 13.05% targeting a move higher to 16.00%, says Societe Generale in a research note to its client.

Corporate borrowers hurt by sanctions face additional burden of $61bn of foreign debt repayments over the next four months (USD buying needs).The CBR has offered loans to help lighten the cost, alleviating pressure on the RUB.

The economy contracted 4.6% yoy in Q2, July CPI edged up to 15.6% from 15.3%. A recent Bloomberg survey shows: 63% of economists expect the CBR will intervene if oil prices fall below $40pbl while 47% see an emergency rate increase, notes SocGen.

CBR on alert to counter market instability

Friday, September 4, 2015 4:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Fed May Tighten Policy if Inflation Stalls Despite Weak Labor Market

Fed May Tighten Policy if Inflation Stalls Despite Weak Labor Market  BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data

BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data  RBA Signals Possible March Rate Hike as Energy Risks Threaten Inflation Outlook

RBA Signals Possible March Rate Hike as Energy Risks Threaten Inflation Outlook  PBOC Scraps Forex Risk Reserve as Yuan Rally Pressures Chinese Exporters

PBOC Scraps Forex Risk Reserve as Yuan Rally Pressures Chinese Exporters  Fed Minutes Signal Steady Interest Rates but Hint at Potential Rate Hikes if Inflation Persists

Fed Minutes Signal Steady Interest Rates but Hint at Potential Rate Hikes if Inflation Persists  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Central and Southeast Europe Economic Outlook: Hungary, Croatia and Serbia Data in Focus

Central and Southeast Europe Economic Outlook: Hungary, Croatia and Serbia Data in Focus