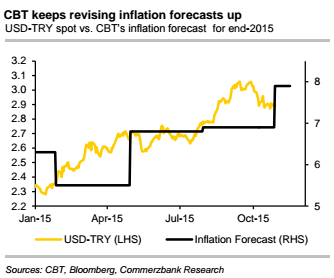

CBT released its Q4 Inflation Report yesterday, once again nudging up inflation forecasts by a sharp 1pp: from 6.9% to 7.9% for end-2015 and from 5.5% to 6.5% for end-2016. This is disappointing, though unsurprising - disappointing because CBT seems to have no game plan despite having to revise inflation forecasts steadily up; unsurprising because September data had already shown core inflation jumping past 8.2%, after which no one believed that the old target could be met.

As the above figure shows, steady lira depreciation is why CBT has had to revise the end-2015 forecast up significantly this year after having initially lowered it in Q1 on the hope that lower oil and commodity prices would prove decisive. Now, CBT attributes 1.2pp additional inflation from lira pass-through for its latest forecast change, while all other drivers are assumed to contribute negatively. But an imporant question remains: what has CBT done about lira depreciation?

"After all, even yesterday, Governor Basci emphasised that steep depreciation is not in Turkey's interest. The actual pace of lira depreciation is resulting in 8.2% core inflation, yet, monetary policy has not changed much in Turkey. Governor Basci did reiterate yesterday that Turkish rates would have to respond to Fed tightening - but so far, it is observed that the mere prospect of Fed tightening has weakened the lira by 20% this year", states Commerzbank.

CBT revises inflation forecasts up by sharp 1pp on lira weakness

Thursday, October 29, 2015 7:52 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022