Manufacturing shipments: Today a factory sales figure of Canada is scheduled to be released. It's a leading economic indicator that shows how quickly manufacturers are affected by market conditions and the prospect of future activity such as expenditure, employment and investment would be reflected on changes in their sales.

Weather disruptions & arbitrage in commodities: We find the large positive price impacts in most food grains and food oils but also smaller positive impacts in some metals and other raw materials where production can also be affected by weather patterns.

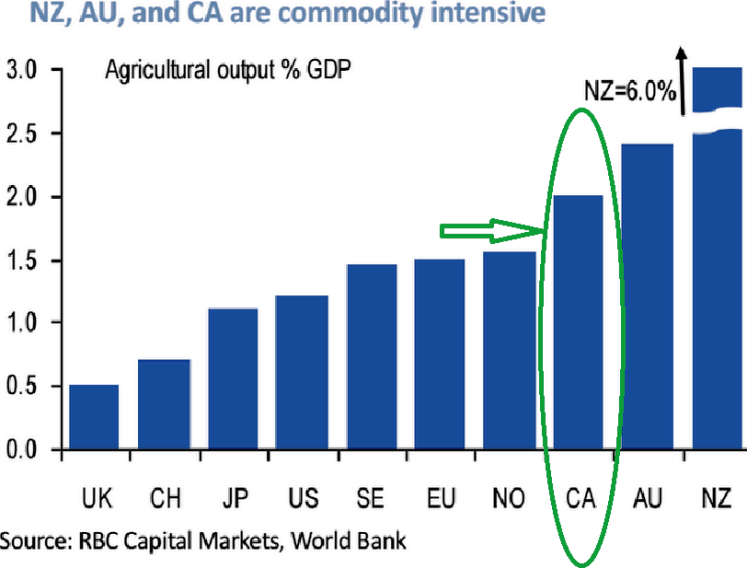

In isolation, these effects should simply play out as a positive terms of trade shock for the countries that are large primary commodity producers and net exporters. In G10, those are New Zealand, Australia, and Canada. However, price effects are only part of the story during a supply shock that has diverse geographical impacts.

The sharp recovery in CAD from its February's low would make OTM calls or OTM puts of AUD/CAD an attractive hedge against core long spot positions. Hence, we recommend below strategy on hedging front.

Options Insights: Bear Put Spread (BPS) (AUD/CAD)

It is a partial hedge strategy which only minimizes the loss if the underlying currency has to move lower but does not cap the loss.

Bear Put Spread shall be used over Protective Put when the premiums on Protective Puts are too costlier.

Bear Put Spread = Protective Put + Sell another Put with lower Strike Price (Out of the Money).

Bear Put Spread reduces the cost of hedge by the premium collected on the OTM Put but it comes at the expense of partial hedge rather than a complete hedge.

Canada’s factory sales likely to stimulate CAD’s ‘Bull Run’, hedge forex risk using CRS

Friday, May 15, 2015 7:55 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary