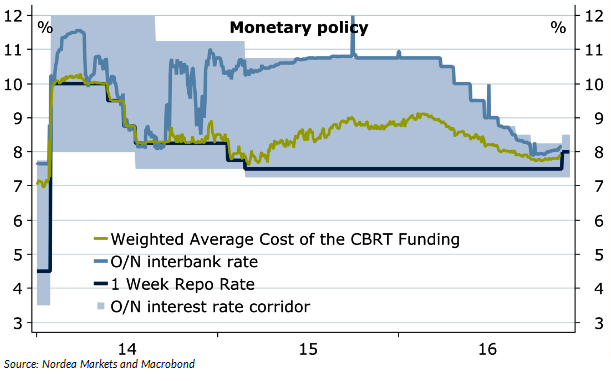

The Turkish central bank, Central Bank of the Republic of Turkey (CBRT) hiked its repo rate during its monetary policy meeting today for the first time since early 2014. The CBRT raised the interest rate by 50 basis points to 8 percent. It also hiked the upper-end of the overnight interest rate corridor by 25 basis points to 8.5 percent and kept the lower-end of the overnight corridor unchanged at 7.25 percent.

This was CBRT’s first repo rate hike since early 2014. This clearly indicates that the Turkish lira has weakened too much and that the inflation target continues to matter, noted Nordea Bank in a research report. The central bank’s further decision regarding the interest rate depends on the country’s inflation outlook and thus implicitly to the Turkish lira. This suggests that there is possibility of additional hikes if the TRY continues to depreciate, added Nordea Bank.

Furthermore, the Turkish central bank lowered the foreign exchange reserve requirement by 50 basis points, adding around USD 1.5 billion of U.S. dollar liquidity to the market, and thus underpinning the lira. This is quite a strong move and is expected to be an important tool in addressing the FX volatility going forward in the central bank’s new monetary policy framework, stated Nordea Bank.

Overall, the Turkish central bank’s move today appears to be on the strong side as compared with projections. The CBRT’s move today would definitely underpin the Turkish lira in the near term; however, the general USD sentiment is expected to stay a strong factor.

Central Bank of Turkey hikes repo rate for first time since early 2014

Thursday, November 24, 2016 12:25 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.