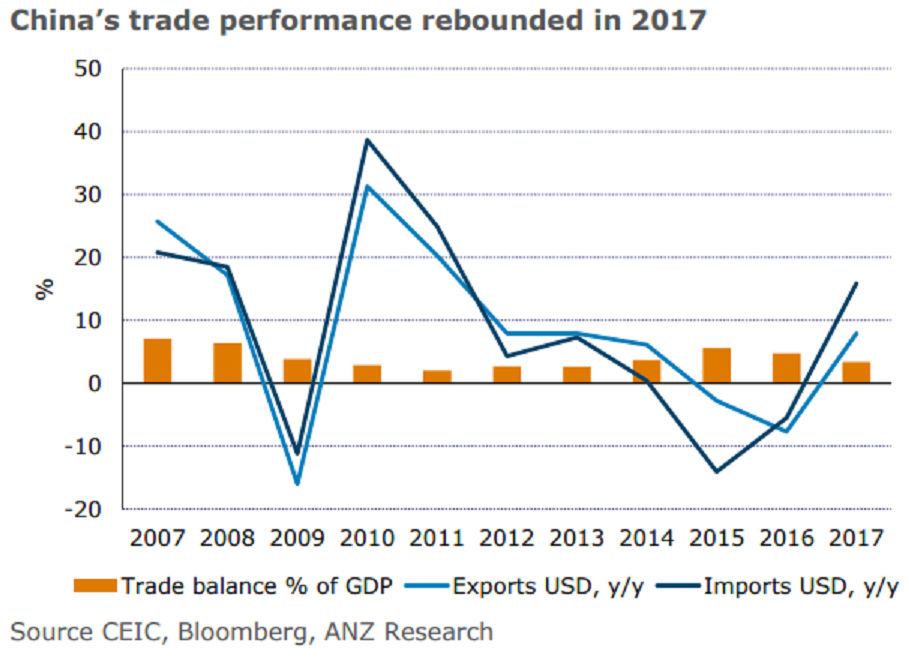

China’s trade outperformed in 2017, ending two years’ contraction, thanks to recovering demand both domestically and abroad. Exports (in USD) grew 7.9 percent y/y in 2017, with exports to major markets including US, EU, and ASEAN up 11.3 percent y/y, 9.1 percent y/y and 7.0 percent y/y (compared with declines across the board in 2016). Imports rose 15.9 percent y/y in 2017, supported by a rebound in domestic demand and higher import commodity prices.

The latter contributed more than half of the headline import growth, according to China Customs. As a result, the trade surplus narrowed to USD422.5 billion (or 3.4 percent of GDP) in 2017 from USD509.7 (4.8 percent of GDP) in 2016.

With a much better trade performance and a steady outlook, concerns about the impact of FX policy on China’s exports may take a back seat. This, together with stable capital outflows and a rising trend in FX reserves, indicates a possibility of further loosening in FX policy in 2018. China’s recent release of promoting cross-border settlements in RMB and adjustment in the daily yuan fixing mechanism is moving towards this direction.

"Uncertainty surrounding Sino-US trade ties might be a key potential downside risk in the near term. While we remain comfortable about China’s export outlook for 2018, there are still uncertainties about Sino-US trade ties which may suddenly erupt," ANZ Research commented in its latest report.

Meanwhile, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals