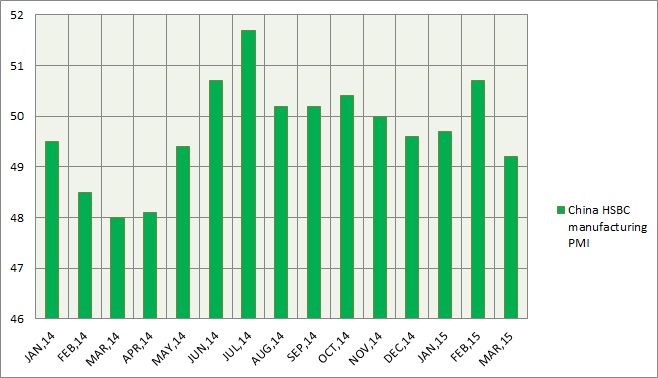

Today preliminary reading for HSBC Chinese manufacturing PMI was released. It provided further evidence that Chinese economy is slowing down.

- PMI reading fell to 11 month low at 49.2 compared to a previous 50.7. A reading below 50 indicates contraction. Since January 2014, only six times Chinese PMI grew. This paints a worrying picture over Chinese economy and its potential to reach 7% growth target, as predicted by policymakers. Details are explained in chart.

Market reaction -

- Party turned sour for copper bulls. Copper rose from $ 3.59/pound to $3.88/pound yesterday after dovish FOMC projections and comments. However it fell close to 3% today, currently trading at $2.8/pound.

- Chinese stock market after consecutive rise for 8 days, fellto 3600today, currently trading at 3690.

- Yuan fell to 6.2150 against dollar today, however recovered some losses and trading at 6.205.

PMI details -

- Output increased at a slower pace. New orders both domestic and export along output prices slowed further.

- Unemployment increased at a faster rate as measured by HSBC.

- Managers reduced the quantity of purchase.

Speculation for further policy ease by Peoples Bank of China (PBOC) rise that might derail Yuan against Dollar. However scope for stock market gains over policy easing remains limited, as slowdown in manufacturing sector might weigh on stock prices.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate