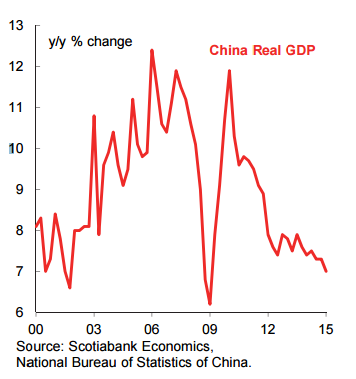

Is China's economy bound to slow when Q2 GDP arrives on Tuesday evening eastern time? Consensus thinks so with the median estimate pegged at 6.8% and almost all estimates below the prior 7% reading for Q1. It may well be somewhat too soon to expect a moderately cooler rate of GDP growth if softer activity in the financial industry keyed off of stock market developments is the reason.

That's because stocks didn't peak until mid-June and thus well into the quarter. During the second quarter, proxies for activity measures like new account openings, trading volumes, and margin loan accounts continued to climb. If the stock market's weakness is cause for expecting softer growth, then it might have to wait until Q3 for that effect to occur. That is expected to be a relatively modest economic impact.

China also releases aggregate financing, exports, retail sales, industrial production, and property prices. It will be a key week for China watchers.

China’s Economy Still Slowing?

Thursday, July 9, 2015 11:47 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022