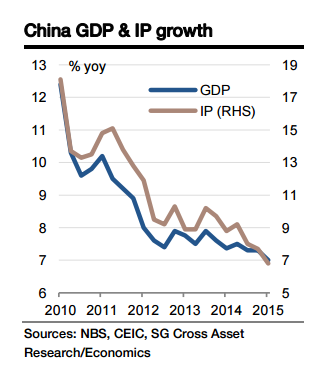

Real GDP growth is expected to slide further from 7% yoy in Q1 to 6.8% yoy in Q2, but qoq growth likely rebounded from 1.3% to 1.4%. Furthermore, June activity data should show further improvement, which is probably more important for near-term policy decisions.

IP growth is likely to have ticked up to 6.2% in June from 6.1% in May; retail sales growth, which did not benefit from the stock market run-up earlier, probably held up well in June, rising 10.3% yoy (vs. 10.1% yoy in May); and fixed asset investment growth could recover to 10.5% yoy in June amid a stronger government focus on infrastructure and a gradual improvement in the housing sector, which however would still drag the year-to-date FAI growth lower to 11.2% yoy from 11.4% yoy.

Currently, the PBoC is not expected to engage in headline easing in Q3, based on the prediction of stabilising economic growth. However, if the data disappoint again, the chances of further RRR or policy rate cuts will undoubtedly rise.

"We do not think the PBoC will use monetary policy easing measures only for the sake of the stock market, given that PBoC is already providing it with targeted liquidity injections," says Societe Generale.

China's Q2 GDP growth to fall to 6.8% yoy, but monthly activity data to improve further

Monday, July 13, 2015 2:16 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX