China's current round of stimulus measures has less to do with external factors and more to do with internal imbalances, created in part by previous stimulus programs. Whether one believes the official statistics of 7% growth or not, there is little doubt that China's economy is slowing. New real estate construction is down -16.8% year-to-date (YTD), electricity consumption is up a mere 1.0% YTD, and motor vehicles sales through August show zero growth relative to last year.

China's economy, however, is also undergoing vast changes, with services today representing more than 50% of GDP, relative to less than 40% in early 2000. This has made tracking Chinese growth more difficult. Encouragingly, what indicators there are of service-related spending seem to point to continued growth. For instance, air passenger traffic is growing over 14% (Y/Y) in person-kilometer terms, while real estate sales are up 7.2% YTD.

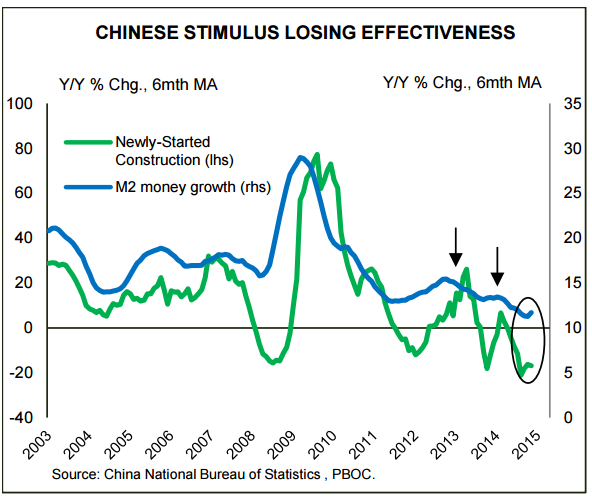

Still, with the overall economy slowing, Chinese authorities have unleashed a number of stimulus measures. In terms of the near-term outlook, more recent stimulus measures have led to an uptick in broad (M2) money growth - up 13.3% over the last two months - which is usually a leading indicator of stronger construction spending ahead.This suggests that economic activity may tick up over the coming months. However, the stimulus is also becoming less effective. China's traditional method of boosting its economy involves providing credit to fund additional infrastructure spending or other investment projects. With non-financial sector debt to GDP up 90pp since early 2008 to roughly 250% (about the same as in America), the ability to take on additional debt is now limited. A simple solution is to target a lower level of growth, thus reducing the need to stimulate as much in the first place.

A continued slowdown in China over the medium term appears inevitable, but the speed and pace remain highly uncertain, given that so much depends on the policies implemented by authorities in a centrally-planned economy

China’s economy is slowing, but also changing shape

Monday, September 21, 2015 8:39 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022