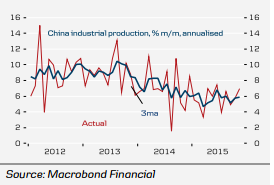

Industrial production in China inched up to 6.2% y/y in November in compare to 5.6% y/y in October, similarly, the monthly figure also increased from 0.5% to 0.6%.

In addition to the industrial output some other key indicators also showed positive sign. M2 money supply rose to 13.7% year on year in November from 13.5% last month. Retail sales also increased marginally from 11.0% y/y to 11.2% during the same period. These indicators show a moderate recovery in Chinese economy.

Fixed asset investment, in contrast, remained steady at 10.2% year-to-date y/y in November.

"However, investment growth is still the weakest in 15 years with particular weakness in real estate investment. This part should pick up next year, though, as higher housing turnover feeds into more construction once the inventory of houses have been depleted", argues Danske Bank.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022