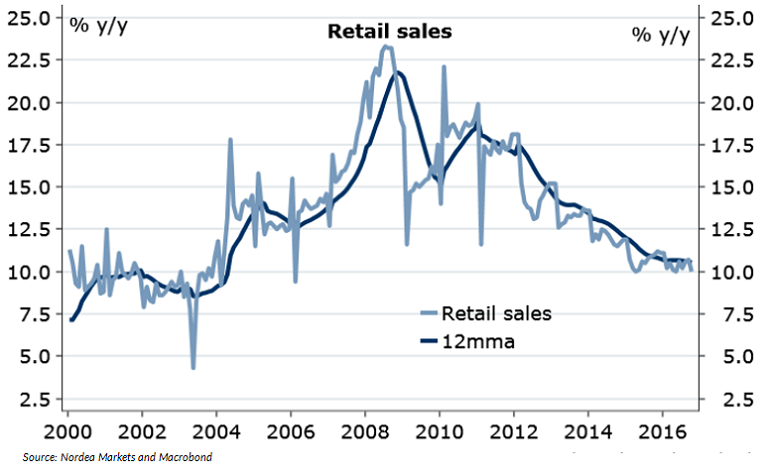

China’s retail sales expanded below projections in the month of October, as opposed to the investment and industrial production figures, which were consistent with expectation and indicated a continued stabilization. Weaker than expected retail sales figures might have been because of seasonal factors, noted Nordea Bank in a research report.

In October, China’s retail sales expanded 10 percent year-on-year, as compared with the consensus expectations of a rise of 10.7 percent. Retail sales in September had grown 10.7 percent. The weaker than expected retail sales should not be seen as a signal that consumers in the nation are becoming bearing, stated Nordea Bank. Even if the household income growth is on a downtrend, it continues to be around 8 percent. Thus, consumption is expected to remain a large potential growth driver of China.

China’s retail sales data have always been greatly volatile and seasonal. According to Nordea Bank, there might be two reasons for retail sales to have come in below expectations in October. Firstly, the first week of October was a long national holiday due to the annual “golden week”. Several Chinese consumers probably spent on travelling and not on buying goods. Moreover, millions have travelled abroad and bought goods there.

Secondly, Alibaba’s “singles day”, a 24-hour shopping event on 11 November, has been a national mania, added Nordea Bank. Several consumers might have waited until November to spend for the planned purchases.

Meanwhile, fixed assets investment expanded 8.3 percent in the initial 10 months of 2016, underpinned by infrastructure and manufacturing. The sharp rebound in the housing market in the beginning of 2016 has helped in playing an important role in stimulating both investment and production. But the market is showing indications of easing due to tighter regulation. Therefore the momentum is likely to deteriorate in 2017, added Nordea Bank.

China’s retail sales grows below expectations in October, likely due to seasonal factors

Monday, November 14, 2016 5:26 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed